Critics of the TPP, and ISDS protections more generally, have often argued that a particular concern is that the US is not only a large source of FDI, but that it is ‘the nation whose corporations use ISDS the most’ (referring to ANU’s Professor Thomas Faunce). A recent paper by ANU’s Dr Kyla Tienhaara for the ‘GetUp’ campaign in Australia, in the context of ongoing parliamentary inquiries into ratifying the TPP, contends that Australia is at risk because US investors have brought multiple claims against Canada. (By contrast, Charles-Emmanuel Cote points out that ‘damages effectively awarded or agreed to in settlement so far [amount to] US$147.5 million, or a mere 0.05 percent of all US investment’ into Canada.) More generally, Tienhaara argues that:

‘The biggest users of ISDS are US multinational corporations. This means that entering into a trade deal with the US that includes ISDS provisions – such as the TPP – places a country at high risk of ISDS suits’.

The inference is that Americans are particularly ‘litigious’ in the field of investment treaty claims – perhaps like they are purported to be with civil litigation in their home courts. In fact, empirical research into comparative civil dispute resolution patterns has long doubted such generalizations. For example, Nottage and Wollschlaeger (‘What Do Courts Do?’ [1996] 369 found that a representative state within the US (in terms of urban/rural population mix and so on, such as Arizona) has fewer civil court filings per capita than countries such as Germany and Israel. The claim rate was also only slightly higher than for England or even New Zealand.

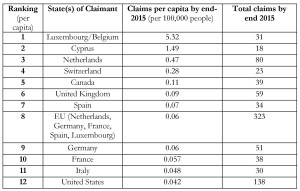

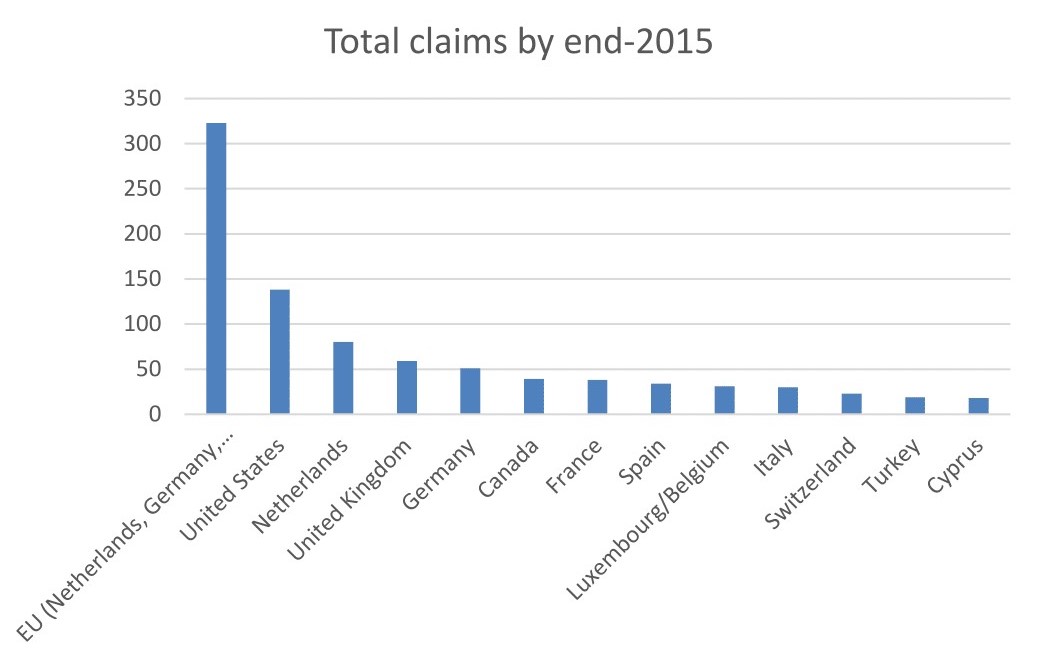

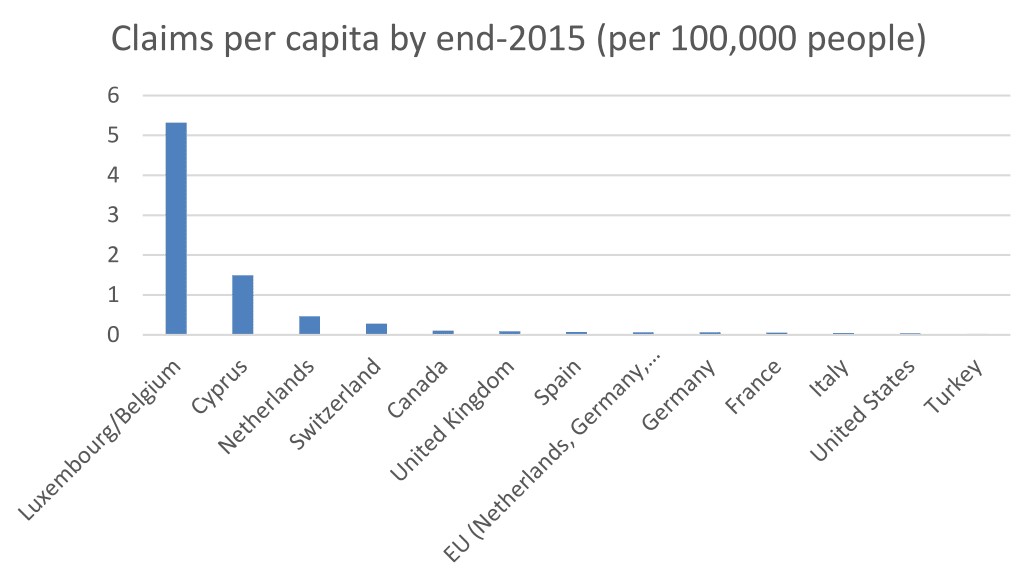

As for ISDS claims, Table A and Figure A-1 below confirm that investors from the US had indeed lodged the most claims by end-2015 (138); but on a per capita basis (per 100,000 people in the home state), US investors are historically less litigious compared to investors from eleven other countries whose investors have filed numerous ISDS claims. Those states are all in the EU (including Belgium and Luxembourg, which generally conclude investment treaties collectively and whose investors have filed the most claims per capita), except for Switzerland (whose investors become the fourth most litigious) and Canada (the fifth most litigious home state). As further indicated in Table A and Figure A-2, if we group together most of these EU states their investors’ per capita ISDS claim rate is also higher than that for US investors.

Most ISDS Claims Filed – Totals vs Per Capita

Admittedly, many of those other more highly-ranked states have historically attracted foreign investment for logistical and/or tax reasons (Luxembourg/Belgium, Cyprus, Netherlands). Some may have come from and remained controlled by US investors, who could have then launched ISDS claims under those countries’ claims (to the extent not precluded from denial of benefits or other treaty provisions), such the first-ever treaty claim against Korea. However, other such investments would have come from outside the US as well as from investors in fact from countries like Belgium; data is hard to come by.

It might also be retorted that per capita claim rates do not accurately reflect litigiousness anyway, in the sense of a propensity to sue based on a comparable corpus of underlying disputes. However, the latter is extremely difficult to determine (even for civil dispute resolution within one country, which is why researchers tend to use per capita filings). A starting point would be to ascertain outbound FDI stocks. Yet by the end of 2015 the US had a very large accumulated volume, even compared to the outbound stocks of major EU states combined (eg UK, Germany, France).

One should then take into account how much of this stock is potentially covered by ISDS-backed investment treaties. The US does have comparatively few IIAs, but some of those concluded by EU states may not originally have had ISDS protections (eg the initial BIT between Germany and Thailand). In addition, some European treaties may have been concluded with counterparties that were less economically significant (thus not generating much additional FDI) compared to those focused on in US treaty negotiations. NAFTA, for example, was an early and economically significant free trade agreement (which also explains why Canadian investor claimants rank quite highly per capita).

It is also possible that the nature of US outbound investment differed from that originating from the EU, Switzerland or Canada. After all, for example, ISDS cases world-wide tend to congregate more on services and primary industry sectors, compared to FDI in manufacturing. Additional research along all these lines would be helpful, although difficult.

Meanwhile, it is certainly more useful for policy-makers and commentators concerned about exposure of host states to ISDS claims by ‘litigious’ foreign investors from particular countries to focus on per capita rates rather than absolute numbers of claims. We may well object to individual claims, such the recent (happily unsuccessful) claims by the (originally US) tobacco company Philip Morris against Australia and Uruguay, but those need to be kept in perspective.

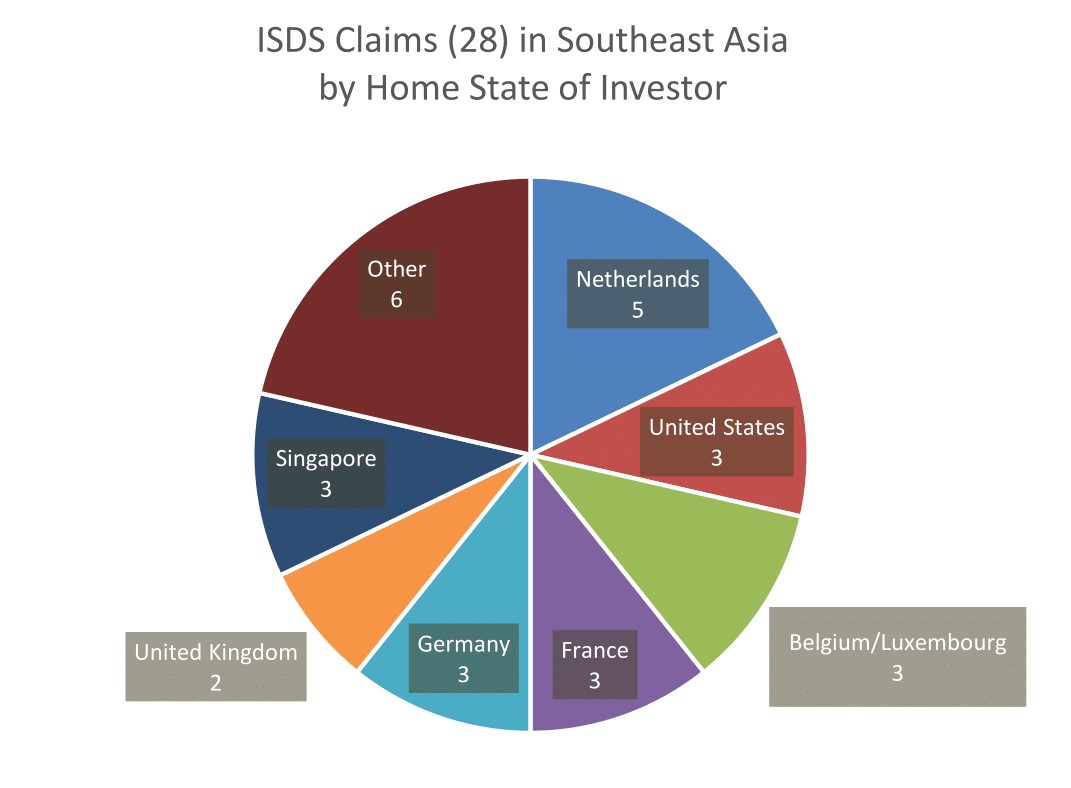

Further, in the Southeast Asian context, one recent study has located 28 total claims (relatively few, given the many investment treaties and large volume of FDI now into that region). Only three claims have been brought by US investors, as indicated in Figure B below. Two were anyway brought by US companies under investment contracts (against Indonesia, eventually obtaining US$2.7m; and failing against Cambodia), while another claim was brought under the US treaty with Vietnam (unsuccessfully). This hardly seems much basis for being concerned about treaties such as the TPP, which includes four ASEAN member state signatories and potentially three more, on the basis that such treaties include the US.

Figure B: ISDS Claims vs Southeast Asian States (Source: Nottage and Thanitcul, “International Investment Arbitration in Southeast Asia”, Sydney Law School Research Paper, November 2016)

Lastly, broader comparative empirical work along the lines outlined above may also be useful in the context of other treaty negotiations currently attracting public attention, such as the Canada EU Trade Agreement. The government of Wallonia (within Belgium) recently voted against signing this treaty, partly because their citizens were concerned about claims from Canada over environmental and social policies. (Later, however, the Belgian government managed to reach a compromise.) To some extent this stance might be justified by per capita ISDS claim rates set out above, although further research is needed to determine whether Canadian investors have been prone to bring claims in relation to environmental measures adopted by host states. Yet the data also indicate that investors from Belgium (plus Luxembourg) have been more active in filing ISDS claims. In general, investment treaties cut both ways.

This comment elaborates on an Appendix to my chapter for an interdisciplinary project into the TPP’s wider impact on Southeast Asia, funded by the Institute of Southeast Asian Studies at NUS and led by Dr Cassey Lee, in turn based on my article on the TPP’s investment provisions forthcoming in the Melbourne Journal of International Law.

________________________

To make sure you do not miss out on regular updates from the Kluwer Arbitration Blog, please subscribe here. To submit a proposal for a blog post, please consult our Editorial Guidelines.