Over the last years, European arbitration institutions show the increasing number of arbitration cases involving Russian and other former Soviet Union countries, most of which are members of the Commonwealth of Independent States (CIS).

Russian parties were second only to local Swedish companies appearing before the Arbitration Institute of the Stockholm Chamber of Commerce (SCC). In addition, the majority of investor-state disputes at the SCC concerned CIS countries.

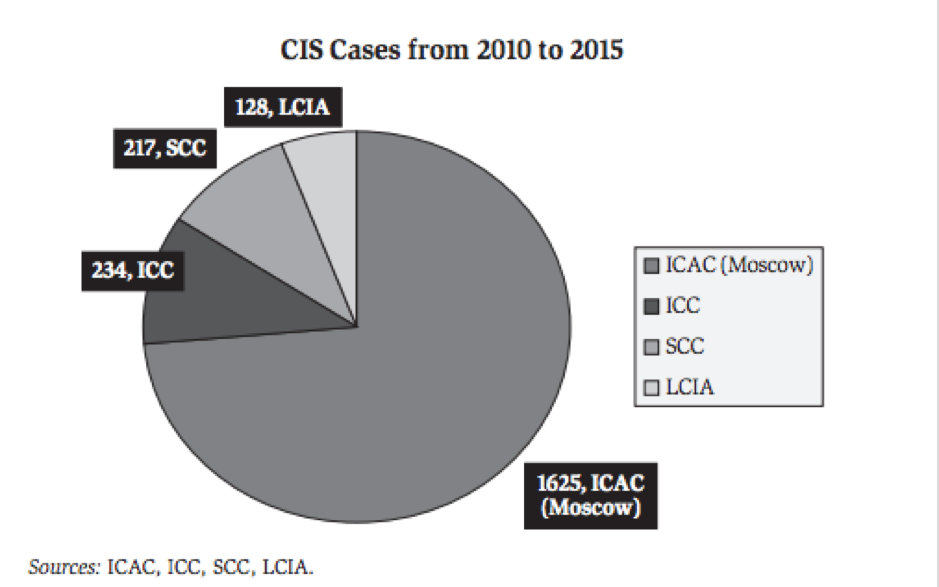

Figure 1. Cases Involving CIS Related Parties on Major Arbitration Institutions

Approximately a third of the London Court of International Arbitration (LCIA) cases involve either a Russian/CIS party or a party ultimately controlled by Russian/CIS entity. Most these cases are governed not by Russian law, but by English law with the choice of London as the seat of arbitration and appointment of English arbitrators. Moreover, CIS businesses often operate via foreign registered companies, which make the real number of Russia-related disputes even higher.

Although the countries of the former Soviet Union are not perceived as arbitration-friendly because of the weak rule of law, many countries in the region have recently modernised their legislation to become more supportive of international arbitration. Arbitration institutions based in the CIS region consider significantly more cases compared to institutions based abroad.

Unusual aspects of international arbitration in the CIS region

Legal systems of the countries of the CIS region share the same roots in the Soviet legal system and several peculiarities, compared to arbitration practices in the West. Unusual aspects of international arbitration in the region include the cautious approach of courts to optional arbitration clauses (which give more procedural options to one party compared to the other).

Another unusual aspect is the possibility under Russian civil law, for a shareholder or a public prosecutor in some cases to apply to a court to invalidate the entire contract containing an arbitration clause, even though they are not parties to the contract. Law of several other CIS countries contain similar provisions.

A distinct characteristic of the CIS arbitration market is that international law firms, rather than domestic firms, often represent parties in international arbitration, usually in close cooperation with local firms. However, this is not usually the case for disputes considered in institutions located in the CIS region. Several domestic CIS firms also successfully represent parties in large cases in the region and elsewhere.

Other common procedural features of the CIS arbitration include such measures as reducing the number of the parties’ submissions, full payment of arbitration costs by the claimant, squeezing proceedings into one hearing limited by time, and resolving disputes mainly based on documentary evidence.

CIS-related disputes are also known for the use of the so-called guerrilla tactics, meaning that the parities ‘will try to exploit the procedural rules for their own advantage, seeing to delay the hearing and (if they get any opportunity) ultimately to derail the arbitration so that it becomes abortive or ineffective’.

The legislation of the CIS countries does not give a clear definition of public policy, in most cases referring just to foundations of law and order of the state, or the basis of the rule of law. This uncertainty gives the courts discretional powers to interpret this concept, and sometimes public policy is interpreted in a very broad manner in order not to enforce awards rendered against state-controlled entities.

Although foreign arbitration users might expect that public policy can be broadly interpreted in the region, in practice most CIS countries rarely set aside or refuse to enforce awards on the basis of expansive interpretation of public policy.

Investor-State disputes involving CIS States

After the Soviet Union disintegrated in 1991, its successor republics urgently sought to attract foreign investors to support the recovery of their economies. Former Soviet states started to conclude bilateral treaties to facilitate cooperation on legal matters within the post-Soviet space. The peak of concluding international treaties concluded by CIS states was in early 1990s.

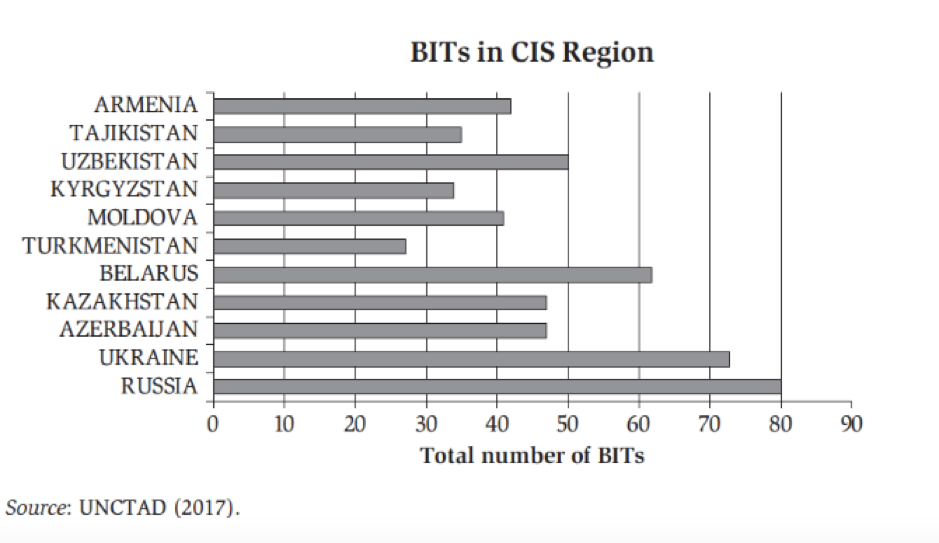

The largest number was concluded by Russia, followed by Ukraine and Belarus. Kazakhstan, Uzbekistan and Moldova each concluded over forty BITs. Tajikistan and Turkmenistan tended to conclude less treaties. In addition, most CIS States are contracting parties to the Energy Charter Treaty (ECT).

Figure 2. Total Number of BITs signed by CIS States

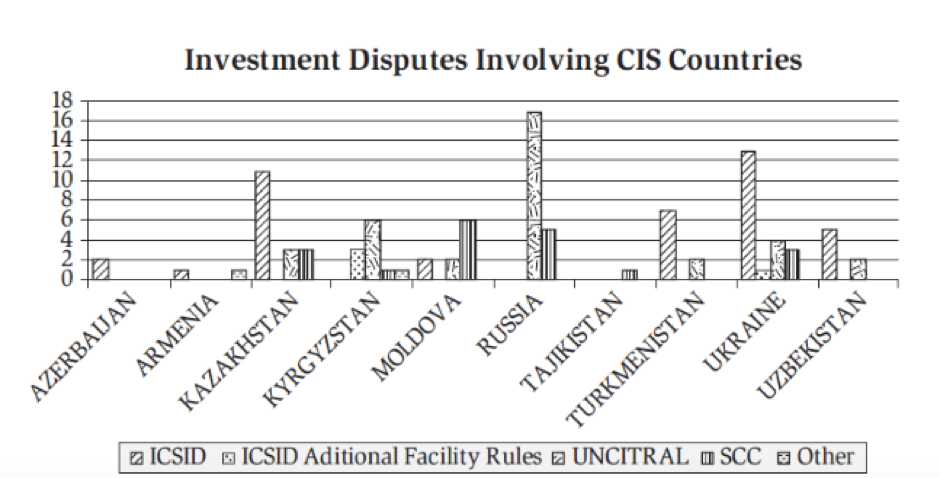

Overall, the countries in the region have concluded more than 550 investment treaties, including BITs, free trade agreements, and other treaties containing investment-related provisions. Typically these treaties provide more than one option for arbitration, including resort not only to ICSID itself, but also to ICSID Additional Facility Rules when the dispute falls outside the scope of the ICSID Convention, the SCC Rules, as well as ad hoc proceedings under the UNCITRAL Rules.

In 2014, Russia, Belarus and Kazakhstan signed and ratified the Treaty on the he Eurasian Economic Union (EAEU). Armenia has acceded to the Treaty, and the relevant accession agreement was ratified by the Parliaments of Armenia and Russia. In 2015, Kyrgyzstan also joined the treaty. The Treaty confirms the creation of an economic union that provides for free movement of goods, services, capital and labour. The Treaty, which entered in force in 2015 also provides a full suite of investment protections, along with a binding investor-state arbitration mechanism.

Figure 3. Total number of investor-States disputes against CIS States

An important novelty of the EAEU Treaty is that it extends common dispute resolution provisions (including ICSID and UNCITRAL options) to investors coming from the Member States of the EAEU.

Understanding international arbitration in the CIS region

The legal framework of many CIS states has significantly improved in recent years because of reform of several CIS states’ legislation on arbitration. Apart from certain controversial proposals regarding the increased regulation of arbitration, the new legislation is a significant step forward in the development of a more arbitration-friendly climate in the region.

With each State has its own peculiarities, investors and lawyers advising them need to understand the law and practice of arbitration in the CIS countries to minimise their risks.

The recently published Law and Practice of International Arbitration in the CIS Region (Kaj Hober & Yarik Kryvoi eds) offers the first comprehensive overview of commercial and investor-state arbitration of the CIS States, including bigger States such as Russia, Ukraine and Kazakhstan and less known jurisdictions such as Moldova, Turkmenistan and Tajikistan.

________________________

To make sure you do not miss out on regular updates from the Kluwer Arbitration Blog, please subscribe here. To submit a proposal for a blog post, please consult our Editorial Guidelines.