Foreign Direct Investment into Africa has increased from $10 billion in 19991)UNCTAD, World Investment Report (2000), p. 40. to $41,8 billion in 2017.2)UNCTAD, World Investment Report (2018), p. 38. Makhtar Diop, former World Bank Vice President for the Africa Region, pointed out that “Intra-African investment is also on the rise, creating a virtuous circle”.3)M. Diop, Y. Li, L. Yong, H.E. Ato Ahmed Shide, “Africa Still Poised to become the Next Great Investment Destination”, June 30, 2015. ICSID statistics also show that the number of newly registered cases involving African States in 2018 is still high with 11 new cases registered by the ICSID Secretariat. Yet, the number of African arbitrators appointed by the parties is low. Meanwhile, if one observes the case details of new registered ICSID cases involving African States in 2018, out of the 11 registered cases, it would seem that no African law firm appears as Counsel to represent a party. This demonstrates that one of the challenges related to Investment Arbitration in Africa is the greater participation of African arbitrators and counsels (I). Greater representation of African arbitrators and counsels would be consistent with the active role already played by African States in the last 50 years in the field of Investment Arbitration and especially before the ICSID. The ICSID jurisprudence is also marked by cases in which African States have been involved. The current role of African States in the development of the next generation of investment treaties is thus not surprising (II).

I. Challenges Related to the Appointment of African Arbitrators and Counsels

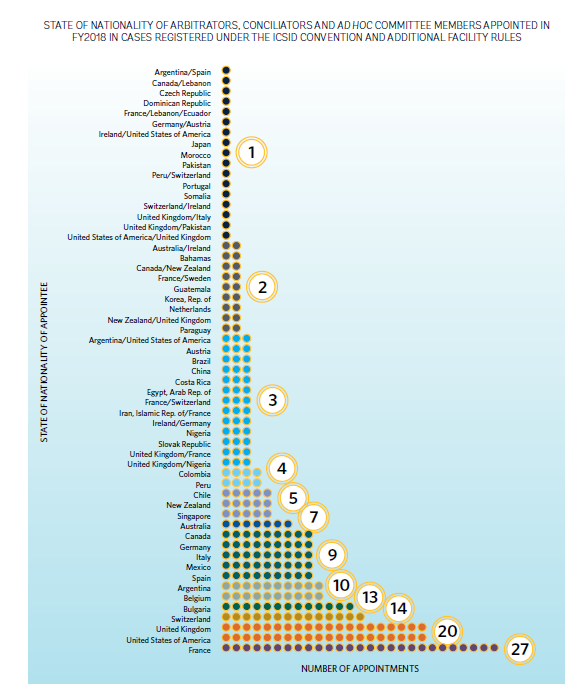

As shown in the chart below, the number of African arbitrators (with a single or dual nationality) is low compared to that of arbitrators from other regions. One of the appointed arbitrators has Moroccan and Somalian nationalities while three other arbitrators have nationalities from the Arab Republic of Egypt and Nigeria. Another arbitrator with a dual nationality (United Kingdom and Nigeria) has been appointed three times. These are very low numbers compared to France (27), the United States of America (20), the United Kingdom (20) and Switzerland (14). Indeed, out of the 57 nationalities represented by arbitrators appointed in an ICSID proceeding only 4 African States are represented.

This chart covers the Year 2018 and takes into account cases registered under the ICSID Convention and the additional facility rules.

Paul-Jean Le Cannu, Team Leader and Legal Counsel at the ICSID, similarly observes that “when comparing the data by region, […] relatively few arbitrators from the African continent have been appointed in ICSID arbitrations”.4)P.-J. Le Cannu, “Foundation and Innovation: The Participation of African States in the ICSID Dispute Resolution System”, ICSID Review, Vol. 33, No 2 (2018), p. 474.

First and foremost, parties, either investors or States, tend not to appoint arbitrators from Africa.

According to Emilia Onyema, who released the SOAS Arbitration in Africa Survey in April 2018, this underrepresentation may be explained by “poor perception of African arbitration practitioners (by their foreign colleagues)” (see a KAB post on the survey here). Similarly, it would seem that African parties do not appoint their peers as arbitrators.6)E. Onyema, and others, « SOAS Arbitration in Africa Survey, Domestic and International Arbitration: Perspectives from African Arbitration Practitioners », 2018, p. 8.

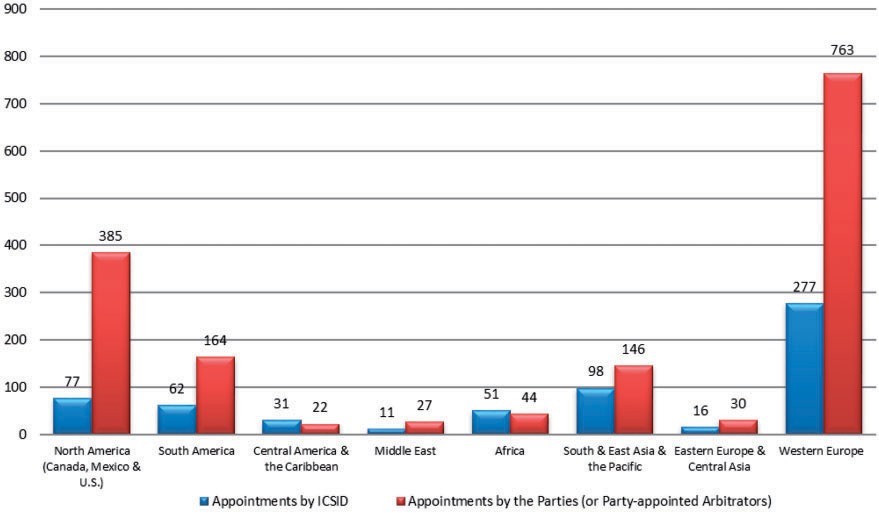

Parties are not the only actors that can help to improve the appointment of African arbitrators. Arbitral institutions also play a significant role. The chart above shows that ICSID already appoints more African arbitrators than the parties themselves. It demonstrates the willingness of leading arbitral institutions to appoint arbitrators from diverse geographical regions. This was precisely one of the goals of the ICC when it launched the African Commission in July 2018.

The above analysis on the under-representation of African arbitrators in International Arbitration is also true regarding the appointment of African Counsels in ICSID proceedings. In the 11 new cases registered by the ICSID in 2018 with an African State involved, no party appears to have retained an African law firm as counsel.

This might change in the near future because there already exists a growing pool of highly qualified African lawyers. The same is true for African students who benefited from specialized International Arbitration program abroad. As African States also develop a similar high-level education program in International Arbitration, the representation of African law firms is also likely to grow in the coming years.

Finally, the development of associations dedicated to arbitration in Africa, such as AfricArb, I-ARB and African Arbitration Association will also help promote African arbitrators and counsels. In addition, African States are making renewed efforts to participate in, and weigh in on, the design of modern international investment standards and dispute resolution.

II. African States’ Ongoing Initiatives in the Next Generation of Investment Treaties

In order to analyse the expected roles of African States in the next generation of investment treaties, it is essential to recall the active role played by African States in the development of the ICSID system.

One must first observe that African States were actively involved in the negotiation and entry into force of the ICSID Convention. Indeed, 15 of the 20 ratifications necessary for the Convention to enter into force came from African States. By 1970, after the first five years of ICSID, the number of African Member States had doubled and reached 29.

It is thus unsurprising that the first cases registered before the ICSID involved a majority of African States (15 out of 25);7)P.-J. Le Cannu, op. cit., p. 463. meaning that the ICSID jurisprudence has therefore been significantly marked by decisions that involved an African State.

It should be reminded that SPP v. Egypt 8)P.-J. Le Cannu, op. cit., p. 464. was the first ICSID case where an Arbitral Tribunal upheld its jurisdiction on the basis of the host country’s investment law, establishing the famous theory of “arbitration without privity”. A few years later, but nonetheless as important as the SPP case, was the decision rendered in 2001 in the Salini v. Morocco case. This decision established another cornerstone of the ICSID jurisprudence by determining the criteria that should be used in the definition of an “investment” under Article 25 of the ICSID Convention.

It follows that African States have an extensive understanding of bilateral investment treaties. African States are thus well placed to propose new provisions, with a more balanced approach, for the next generation of investment treaties at either a bilateral, a regional or a continental level.

Out of 2971 BITs signed worldwide, 994 involve an African State and 194 are intra-Africa States. For instance, the Morocco-Nigeria BIT signed on 3 December 2016 is perceived as a model for the next generation of BIT as it includes new obligations for investors such as environmental and social impact assessments (see a KAB post on this topic here). Meanwhile, African States are currently negotiating the investment chapter, including the dispute resolution mechanism, of the African Continental Free Trade Agreement.

The above analysis shows that African States have played a significant role in the development of investment arbitration. The ongoing initiatives in the drafting of the next generation of investment treaties demonstrate that African States are willing to keep this positive function to be major actors for the future of International Arbitration. So does their involvement in the current rules amendment process at ICSID, along with other Member States and Convention signatories.The UNCITRAL Rules on Transparency in Treaty-based Investor-State Arbitration is another typical example of their important contribution. Mauritius, the first State to have signed and ratified this convention, gave its name to this Treaty. Mauritius was followed by Cameroun and Gambia, putting African States, once again, at the forefront in the ratification of new instruments designed to improve the international investment arbitration system.

________________________

To make sure you do not miss out on regular updates from the Kluwer Arbitration Blog, please subscribe here. To submit a proposal for a blog post, please consult our Editorial Guidelines.

References

| ↑1 | UNCTAD, World Investment Report (2000), p. 40. |

|---|---|

| ↑2 | UNCTAD, World Investment Report (2018), p. 38. |

| ↑3 | M. Diop, Y. Li, L. Yong, H.E. Ato Ahmed Shide, “Africa Still Poised to become the Next Great Investment Destination”, June 30, 2015. |

| ↑4 | P.-J. Le Cannu, “Foundation and Innovation: The Participation of African States in the ICSID Dispute Resolution System”, ICSID Review, Vol. 33, No 2 (2018), p. 474. |

| ↑5 | P.-J. Le Cannu, “Foundation and Innovation: The Participation of African States in the ICSID Dispute Resolution System”, ICSID Review, Vol. 33, No 2 (2018), p. 474. |

| ↑6 | E. Onyema, and others, « SOAS Arbitration in Africa Survey, Domestic and International Arbitration: Perspectives from African Arbitration Practitioners », 2018, p. 8. |

| ↑7 | P.-J. Le Cannu, op. cit., p. 463. |

| ↑8 | P.-J. Le Cannu, op. cit., p. 464. |