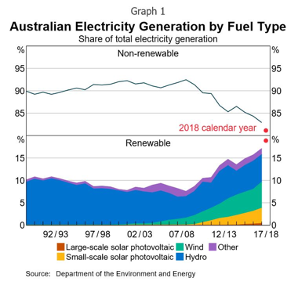

The Renewable Energy Target (RET), Australia’s key policy instrument for encouraging electricity generation from renewable sources, has been described as a policy hampered by politicisation. Notwithstanding such criticism, in 2019, it was reported that Australia’s energy system is undergoing the transition to renewables faster than any other country in the world.1)Blakers et al., (2019) “Pathway to 100% Renewable Electricity”, IEEE Journal of Photovoltaics, Vol. 9, No 6, cited in the 2020 Integrated System Plan at pages 8, 10, 21. Against this backdrop, Australia remains attractive for investments in clean energy, and there continues to be a considerable inflow of foreign capital, particularly from overseas solar and wind developers.

Investment protections for renewable energy projects

The uncertainty faced by investors in the renewable energy sector over recent decades is not unique to Australia. It is largely a symptom of the long lead-time and capital-intensive nature of large scale renewable energy projects, resulting in a reliance – at least in part – on favourable regulatory frameworks and supportive government policies. That support can take many forms, including improvements in energy efficiency, the implementation of tradable certificate schemes (as adopted in Australia under the RET model), and the payment of fixed feed-in tariffs or market premiums to electricity producers from renewable sources.

As the experience in Spain and other European states has demonstrated, incentive schemes can be prone to reduction and retraction, particularly in times of financial crisis. Such changes can have a dramatic impact on the profitability of renewable projects. In this context, renewable energy investors in several European states have looked to the protections available to them in international trade agreements and treaties. The treaty most frequently invoked for this purpose is the Energy Charter Treaty (ECT), an international multilateral investment agreement which has the aim of promoting international cooperation in the energy sector. The ECT – and the ongoing discourse surrounding its modernisation – has been the subject of several recent Kluwer Arbitration Blog posts.

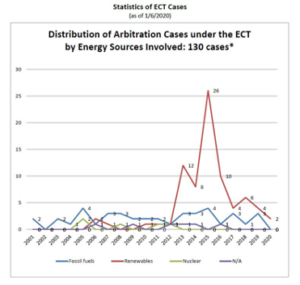

There are numerous examples of how the investment protections set out in the ECT have been invoked through ISDS where political or regulatory changes have eroded the profitability of renewable energy projects. Indeed, available data suggests that of the ISDS claims initiated under the ECT (as at 31 July 2020), approximately 60% (or 78 of 131) are claims made by investors in the renewable energy sector. The dramatic increase in ISDS claims initiated by renewable energy investors under the ECT over recent years is illustrated below.

Source: Statistics of ECT Cases (as of 1/6/2020), Energy Charter Secretariat (2020)

Investment arbitration lessons for foreign investors in Australia?

Australia has signed, but not ratified, the ECT. As such, its provisions are not strictly binding on Australia. However, the investment protections set out in the ECT are broadly representative of the types of protections available to foreign investors under Australia’s (binding) treaty commitments. These mechanisms are found in the numerous bilateral and multilateral agreements to which Australia is a signatory.2)Australia–New Zealand Closer Economic Relations Trade Agreement (ANZCERTA); Singapore-Australia Free Trade Agreement (SAFTA); Australia–United States Free Trade Agreement (AUSFTA); Thailand–Australia Free Trade Agreement (TAFTA); Australia–Chile Free Trade Agreement (AClFTA); Malaysia–Australia Free Trade Agreement (MAFTA); Korea–Australia Free Trade Agreement (KAFTA); Japan–Australia Economic Partnership Agreement (JAEPA); China–Australia (ChAFTA); Australia-Hong Kong Free Trade Agreement (A-HKFTA); Peru-Australia Free Trade Agreement (PAFTA); Indonesia–Australia Comprehensive Economic Partnership Agreement (IA-CEPA); ASEAN–Australia–New Zealand Free Trade Agreement (AANZFTA); Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP). It is also relevant to note that on 16 November 2020, it was announced that Australia had joined 14 other states in signing the Regional Comprehensive Economic Partnership (RCEP), which has been described as the ‘world’s largest free trade deal’. Although there is no ISDS mechanism in the RCEP, it constitutes a landmark statement in favour of free-trade and multilateralism by the new Indo-Pacific trading bloc.

While Australian companies have successfully enforced the protections available to them under Australia’s investment treaty commitments (in respect of their investments abroad), Australia has so far managed to shake off claims brought against it. The only claim made against Australia to date was that advanced by Philip Morris Asia in respect of the introduction of plain packaging for tobacco products, which Australia successfully defended on jurisdictional grounds.

Recognising Australia’s limited experience as a respondent to ISDS claims (and notwithstanding its status as a non-ratifying signatory of the ECT), the ECT arbitrations against Spain and other European states offer important lessons about the interpretation of investment protections in a renewable energy context:

- The apolitical nature of ISDS decisions: Where renewable energy investors have been successful, it is not because their projects have been given ‘special treatment’ or deemed so important as to outweigh the operation of the host state’s sovereign right to regulate. Rather, the outcome is arrived at following a distinctly apolitical process. Throughout that process, tribunals are plainly concerned with the need to strike a balance between, on the one hand, the investors’ desires for a fair and consistent regulatory framework and, on the other, the host states’ mandates to implement legal and regulatory changes. This demands a nuanced application of the relevant investment protections, with due regard for the relevant political, economic, and social factors at play. In this way, the broad (and on one view, vague) wording of the investment protections allows tribunals the flexibility to determine the appropriate standard of treatment owed to investors in each case.

- The consequences of the host state’s commitment to investors: In considering whether there has been a breach of the ‘fair and equitable treatment’ (FET) standard, tribunals have considered whether – on an objective analysis – the host state actively fostered or instilled an expectation in the mind of the investor that its investment would be treated with a certain degree of stability. If the investment was procured on the basis of a specific promise or commitment by the host state (for example, that the host state would not make changes to a favourable regulatory framework, or that if it did, those changes would not impact the investment in question), the host state will likely be held to that promise. As the Tribunal in Cube Infrastructure v. Spainobserved (at [409] – [410]), if the host state makes a representation that induces investment, it must either deliver on that representation or ensure that any adjustments do not significantly alter the economic basis of the investments made in reliance on that representation.

- The relevance of the public interest objective: In considering the specific act of the host state that has given rise to the claim (for example, the retraction or significant reduction of a guaranteed feed-in tariff), the public interest objective underscoring that act will be a relevant consideration. For example, in Charanne v. Spain (at [535]), the Tribunal considered the pressing need to limit the tariff deficit in the solar energy sector, which had been worsening year by year. However, this does not involve the making of a value judgment about the perceived necessity or quality of the regulatory measure in question. Rather, the measure is assessed through the lens of whether or not the investor, in the precise circumstances of each case (and taking into account the nature of any specific promise or commitment by the host state), ought to have expected it.

- The investor’s duty to assess the regulatory landscape, including the likelihood of change: On the other side of the coin, tribunals have considered whether the investors’ expectations were rigid and unrealistic, or allowed for reasonably foreseeable changes. Investors cannot eliminate the possibility that the host state will exercise its sovereign prerogative to implement new measures, or to increase the impact of existing measures, in accordance with a legitimate public interest objective. Since economic, environmental, and social considerations are necessarily dynamic, an investor must be able to demonstrate that it exercised due diligence in appraising the landscape of its potential investment. In other words, the pursuit of stability must be largely driven by the investor’s own efforts. In Cube Infrastructure, the Tribunal emphasised (at [357]) that investors were never entitled to expect that the regulatory regime would remain completely unchanged.

- The limitations on an investor’s duty to predict (and accept) change: Like Cube Infrastructure, the Tribunal in SolEs Badajoz v. Spain considered the impact of changes to Spain’s renewable energy incentive scheme (known as the ‘Special Regime’) in 2013 and 2014, in addition to the original amendments that were made to the Special Regime in 2010. The Tribunal found (at 449]-[453]) that the 2010 amendments had an adverse impact on the claimant’s revenue, but did not fundamentally change the key features of the Special Regime, nor were they disproportionate to the policy objectives of those measures (i.e. the reduction of the tariff deficit). Accordingly, the amendments were found to be consistent with Spain’s obligation to accord fair and equitable treatment to the claimant’s investment. However, the 2013 – 2014 amendments were found to have fundamentally changed the basic features of the Special Regime, exceeding the changes that the claimant could have reasonably anticipated when it made its investment. Accordingly, the Tribunal concluded that Spain had violated the FET standard.

Conclusion

The question of whether there is a causal link between the availability of ISDS under any international investment agreement and increased foreign direct investment has not been answered in any definitive way. It is even less clear whether Australia’s commitment to treaties which include investment protections (and recourse to ISDS) makes Australia a more attractive prospect for foreign investors than it would otherwise be (and relevantly, the Australian government is presently conducting a review of its bilateral investment treaty program – discussed here). In the circumstances, it is difficult to make the positive assertion that the availability of ISDS in Australia offers renewable energy investors the kind of comfort that would sound in tangible financial benefits, such as reduced risk premiums.

That said, regulatory and political risk continues to impact the flow of foreign capital and technology into the renewable energy sector in Australia, and if treaty protections were not available at all, they could not be factored into a broader assessment of the risk associated with a potential project. At the very least, Australia’s acceptance of ISDS-backed treaties demonstrates to foreign investors that its legal framework, as applicable to the prospective investment, is aligned with international norms and standards. There are enough examples of those standards being enforced by renewable energy investors in Europe, in a wide array of different factual and technical contexts, to provide investors with an understanding of what they are entitled to expect from host states.

Similarly, the ever-growing body of case law in this field should be closely examined by state signatories – Australia included – who have committed to afford foreign investors a certain standard of treatment under international law. These case examples offer valuable insight into the importance of regulatory and political consistency in the renewables sector, which cannot be overstated at such a critical juncture in Australia’s clean energy transition.3)The authors wish to acknowledge the research assistance provided by Rebecca Lucas, a solicitor in Herbert Smith Freehills’ Disputes team. The authors are members of ACICA45, a group established by ACICA with the aim of responding to the needs of young and emerging arbitration practitioners keen to learn more about arbitration and be involved in the arbitration community. The views expressed by the authors are their own.

________________________

To make sure you do not miss out on regular updates from the Kluwer Arbitration Blog, please subscribe here. To submit a proposal for a blog post, please consult our Editorial Guidelines.

References

| ↑1 | Blakers et al., (2019) “Pathway to 100% Renewable Electricity”, IEEE Journal of Photovoltaics, Vol. 9, No 6, cited in the 2020 Integrated System Plan at pages 8, 10, 21. |

|---|---|

| ↑2 | Australia–New Zealand Closer Economic Relations Trade Agreement (ANZCERTA); Singapore-Australia Free Trade Agreement (SAFTA); Australia–United States Free Trade Agreement (AUSFTA); Thailand–Australia Free Trade Agreement (TAFTA); Australia–Chile Free Trade Agreement (AClFTA); Malaysia–Australia Free Trade Agreement (MAFTA); Korea–Australia Free Trade Agreement (KAFTA); Japan–Australia Economic Partnership Agreement (JAEPA); China–Australia (ChAFTA); Australia-Hong Kong Free Trade Agreement (A-HKFTA); Peru-Australia Free Trade Agreement (PAFTA); Indonesia–Australia Comprehensive Economic Partnership Agreement (IA-CEPA); ASEAN–Australia–New Zealand Free Trade Agreement (AANZFTA); Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP). |

| ↑3 | The authors wish to acknowledge the research assistance provided by Rebecca Lucas, a solicitor in Herbert Smith Freehills’ Disputes team. The authors are members of ACICA45, a group established by ACICA with the aim of responding to the needs of young and emerging arbitration practitioners keen to learn more about arbitration and be involved in the arbitration community. The views expressed by the authors are their own. |

Helpful summary, thanks.

Re “the availability of ISDS under any international investment agreement and increased foreign direct investment”, see eg my empirical analysis with ANU economist Shiro Amstrong funded by ARC at https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2824090, and other studies mentioned in my Submission to the current Australian Government review of remaining old BITs (on the DFAT webiste or via https://erga-omnes.sydney.edu.au/2020/09/submission-to-dfat-consultation-on-review-of-australias-bilateral-investment-treaties/).

Re “no ISDS mechanism in the RCEP”, at least fo now, almost all pairs of the 15 signatories already have at least one ISDS-backed investment treaty anyway to provide more credible enforcement of substantive protections (although RCEP might add especially some liberalisation / pre-establishment commitments), as tabulated in the intro chapter of my new eds book (manuscript version at https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3635795): https://lrus.wolterskluwer.com/store/product/new-frontiers-in-asia-pacific-international-arbitration-and-dispute-resolution/