Commensalism of IIL Critique

While the popular criticism of investment arbitration provides fertile ground for the academic proposals for ISDS reform, the latter hardly shape the development of (investment) law and even less so, its popular perception. Reform proposals are usually firmly grounded in positive law, and as such they are inherently constrained. Alternatively, general overhaul suggestions are taken with a pinch of salt for lack of normative basis.

We should thus cherish the opportunity when ambitious ideas can shape reality. This may be the case of the Netherlands draft model BIT, notably its two articles on the Rule of Law and Corporate Social Responsibility (CSR).

Dutch Trailblazers

Why could this Model BIT be a breakthrough? Two reasons: the geopolitical context and the unique position of the Dutch BITs. From the geopolitical perspective, populists swept through liberal democracies by questioning international order and normative constraints on governments. Sufficient to recall the U.S. withdrawal from UNESCO, the Paris climate agreement, the JCPOA, and UN Human Rights Council, and derailing TTIP, NAFTA and TPP talks. Obviously, the clash between yearning for freedom and security is nothing new. There is no reason to assume that this time the renouncement of Rule of Law (RoL) and Escape from Freedom will not take us on Road to Serfdom. Accordingly, despite the recent backlash against ISDS, the general public may soon reconsider its desirability.

As for the Dutch BITs, they are the second most-frequently used basis for bringing investment claims (1987–2016). If the Netherlands remains committed to curtailing tax evasion, notably through the new requirement of substantial business activities (Art. 1(b)(ii)), their attractiveness will drop. However, they will still constitute an important normative benchmark.

Investment Tug-of-War

The criticism of investment arbitration has various facets, but it mostly amounts to the “private, secret courts” disregarding public concerns. It reflects the phenomena of changing geometry, where social sympathies for “our” entrepreneur struggling against administration shift, once the “selfish” investor files a claim against “our” government. An investor is thus accused of reaping the benefits of a BIT without taking the host country’s interests into account. So far, the response has been to strengthen the government’s capacity to protect the public interest, notably with the right to regulate (Dutch Model BIT, art. 2(2)). Also, the other narrative – luring investors and then abusing the host advantage – entails broadening of treaty protection. Yet, waging a normative arms race creates the risk of losing the rationale behind International Investment Law (IIL).

(Towards) the Dutch Formula

The striking feature of both strands of criticism is that they describe the investor-state interactions in some form of a symbiotic relationship: the commensalism of the foreign investor reaping the benefit of ISDS without a counter contribution, or parasitism, where the host-state, having locked-in the foreign investment, may strip it of profitability. Hence, two elements, and a missing link, deserve particular attention in the Dutch model BIT.

Starting with the Rule of Law, Art. 5 stipulates:

-

The Contracting Parties shall guarantee the principles of good administrative behaviour, such as consistency, impartiality, independence, openness and transparency, in all issues that relate to the scope and aim of this Agreement.

-

Each Contracting Party shall ensure that investors have access to effective mechanisms of dispute resolution and enforcement, such as judicial, quasi-judicial or administrative tribunals or procedures for the purpose of prompt review, which mechanisms should be fair, impartial, independent, transparent and based on the rule of law.

-

As part of their duty to protect against business-related human rights abuse, the Contracting Parties must take appropriate steps to ensure, through judicial, administrative, legislative or other appropriate means, that when such abuses occur within their territory and/or jurisdiction those affected have access to effective remedy. These mechanisms should be fair, impartial, independent, transparent and based on the rule of law.

It is not an all-new provision. RoL lurks in various normative components of modern BITs. IIL can even be “squared with” the concept of RoL and the idea of “equality before the law”, which is inherent to it. And yet, it is hardly ever acknowledged explicite. Model treaties of Brazil, Colombia, Czech Republic, Germany, Mexico, the UK, or the US, or even those which are renowned for its progressive wording, as in India, do not stipulate RoL per se. Another progressive Norwegian model reaffirms the commitment to the Rule of Law in the preamble. So does the Austrian model or the Swiss Confederation-China FTA. More ambitious is the EU-Korea and EU-Vietnam Framework Agreement (RoL constitutes “an essential element” of the agreement).

As for the Dutch model, the wording of the RoL clause poses practical concerns. For instance, the notion of RoL appears both in the title of the above-mentioned article and its paragraphs 2-3, where it is just one of the prerequisites of dispute resolution and enforcement (the others—fairness, impartiality, independence, transparency—usually considered as pillars of RoL). Also, the article mentions administration and judiciary, which raises the question as to the applicability of RoL to the law-maker. All this is provided without mentioning the ephemeral normative contents of the RoL; as studies by the International Law Association on the Rule of Law and International Investment Law show, although RoL is a universal concept, its contents vary significantly between jurisdictions.

And yet, matched with specific duties under the Fair and Equitable Treatment clause (Art. 9(2)), this could be the first in a two-stage path towards equilibrium between host-state rights and duties vis-à-vis an investor. Instead of enumerating ever-new state competences, such a general clause should be paired with a clear acknowledgement of the public nature of IIL, the goals and purposes of the treaty and the respective socio-economic role of investors.

Furthermore, the RoL clause would serve as an antidote for a legitimacy crisis. Not only it can provide the formal and substantive underpinning for restoring legitimacy, but also be flexible enough to accommodate regional differences.

Equilibrium requires counterbalance. By virtue of Art. 7(2), the parties stipulate:

The Contracting Parties reaffirm the importance of each Contracting Party to encourage investors operating within its territory or subject to its jurisdiction to voluntarily incorporate into their internal policies those internationally recognized standards, guidelines and principles of corporate social responsibility that have been endorsed or are supported by that Party, such as the OECD Guidelines for Multinational Enterprises, the United Nations Guiding Principles on Business and Human Rights, and the Recommendation CM/REC(2016) of the Committee of Ministers to Member States on human rights and business.

A similar provision can be found in other BITs, such as the India model BIT, which calls on investors to “endeavour to voluntarily incorporate internationally recognized CSR standards” (similarly in the Brazil model BIT). States may undertake to adopt some CSR-fostering measures (e.g., investor duties stemming from domestic law). This mostly occurs through soft obligations (e.g., Canadian treaties, including the Canada–Nigeria BIT (2014) and the Canada–Mali BIT (2014), some EU treaties such as the EU–Vietnam Framework PCA and the Norwegian model BIT. Sometimes, CSR is merely signalled in the Preamble (China–Switzerland FTA (2013), Czech model BIT). However, some treaties include obligations binding directly on investors. For instance, the Morocco–Nigeria BIT (2016) obliges investors to conduct a social-impact assessment.

Hence, stressing the “importance” of “encouraging” investors to “voluntarily incorporate” CSR standards, even matched with the additional CSR-related duties (art. 7(1, 4)) and provisions on the sustainable development (Art. 6), is not overzealous. And yet, the whole could be greater than the sum of its parts.

The Synergy of Investment Promotion and Protection

Trying to conceptualise the actual and desirable relationship between both articles, it is necessary to start with an acknowledgement that they are excluded from the scope of ISDS (Art. 16). When put in the normative context, RoL as an element of “promotion and facilitation” of investments (section 2) and CSR as an element of sustainable development (section 3), it turns out that both become subsequent steps in the normative tug-of-war. Is that all we can get?

Instead, RoL and CSR should in tandem perform the balancing function in the review of compatibility of a state’s actions with its duties towards an investor: 1) an interpretation guideline and 2) flexibility feature of the normative contents:

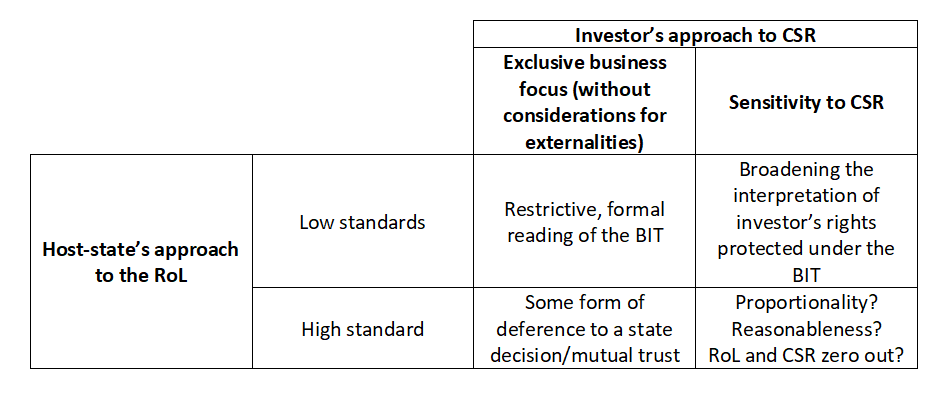

Ad. 1) This could take various normative embodiments, both in terms of treaty wording and arbitral practice. For instance, a normative test consisting of two factors: adherence to a particular RoL standard by the host-state compared with a CSR standard applied by the investor. Espousing a high or low level of the standards would influence a tribunal’s perception of public actions. In light of the local RoL acquis, on the one hand, and the investor’s approach to the social (and environmental) responsibilities, limitations of investor rights should be more or less likely to be read as, for instance, violating legitimate expectations or FET.

Ad 2) The advantage of flexible normative contents reflects a lack of a universal understanding of the normative contents of RoL (not to mention CSR standards). Accordingly, a model BIT should stipulate a fair equilibrium of rights, in which the normative contents would adapt to the specific context.

When it is seen from a broader perspective, the social capital constitutes the blood in the circulatory system of the liberal democracy and free-market. It allows entrusting power from one to another, subject to expectations that it will be exercised for the mutual benefit. Thus, investment arbitration is supposed to broaden cooperation networks beyond family and friends. To the contrary, the current legitimacy crisis undercuts ratio legis of ISDS, rendering it counter-efficient and economically unreasonable. Whether one believes that IIL is structurally tainted or that it compromised its original mission, restoring the trust between foreign investors, host states and host population is necessary for the subsistence of ISDS in the long run. Paradoxically, the broader crisis of liberal democracy provides a great opportunity for such a reform effort as the demand for impartial, yet trusted, investor-state arbitration will increase. The Netherlands is on the brink of such a major contribution to international law. The beauty of the new Model BIT is the opportunity to both address the most pressing challenges of IIL and harness its ever-greater legal complexity by restoring the conceptual underpinning of the system. Just to seize the opportunity.

________________________

To make sure you do not miss out on regular updates from the Kluwer Arbitration Blog, please subscribe here. To submit a proposal for a blog post, please consult our Editorial Guidelines.