The 4th ICC European Conference on International Arbitration took place on Tuesday 7 July 2020, during the second day of the Paris Arbitration Week. This first-ever digital edition saw record numbers with 1,450 participants connecting from all corners of the world.

Alexis Mourre, President of the ICC International Court of Arbitration, acknowledged in his welcome address the difficult times businesses are facing and emphasised the role that arbitration and its community play “in ensuring that justice continues to be made in international disputes, decisions are not delayed and unnecessary costs are spared to the parties”.

The ICC Court and its Secretariat took immediate action to adapt to the COVID-19 pandemic.1)On 9 April 2020, the ICC published its Guidance Note on Possible Measures Aimed at Mitigating the Effects of the COVID-19 Pandemic previously discussed on the blog. Since March 2020, the ICC Court has held 50 remote court sessions, scrutinised 170 draft awards, decided on 22 challenges, processed 117 requests for arbitration, administered 6 Emergency Arbitrator applications and made 641 other procedural decisions.

Alexis Mourre further acknowledged the changes brought about by the COVID-19 crisis, which prompt for virtual hearings as the norm rather than the exception, at least for cases which do not require extensive evidence and have limited amounts in dispute, and for paperless post-COVID-19 practices in the near future.

Alexander Fessas, Secretary General of the ICC International Court of Arbitration and Director of the ICC Dispute Resolution Services, who successfully led the ICC Dispute Resolution Team during this unprecedented crisis, once again called for caution and celebration as for the previous year, but emphasized that in the current context, access to justice must be maintained, and new avenues for dispute resolution processes should be found.

The ICC Secretary General reflected on the transformative process that we are all witnessing in the world of dispute resolution, and the questions this raises with regards to new disputes arbitral tribunals will hear, new areas to explore, and new processes and procedures to develop in order to offer new and adapted services.

Laetitia de Montalivet, ICC’s Regional Director for Europe, introduced the topics of the two conference panels and thanked the members of the program committee, led by Yas Banifatemi and Erica Stein.

First panel chaired by Professor Ruiz Hélène Fabri, Director of the Max Planck Institute for Procedural Law tackled the topic of “Tariff Wars and Supply Chains: Disputes in the making? Sharing views on Europe at the crosshairs of the latest United States/China trade disputes”

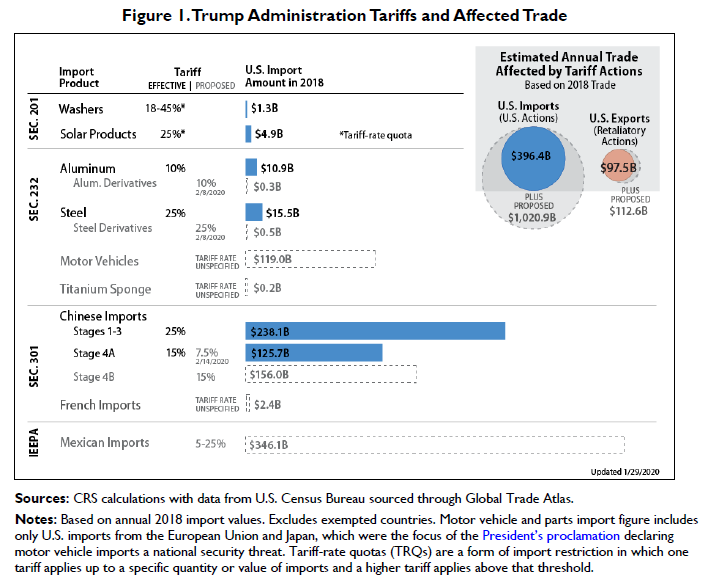

James Mendenhall, Partner in Global Arbitration, Trade and Advocacy at Sidley Austin (Washington D.C.), kicked off the discussion and gave an overview on “where we are” on the tariff wars and on the “state of play” in the U.S., while addressing the implications of the resulting dispute settlements. Under the Trump administration, a number of tariffs were applied with an adverse effect on trade results, as the graphic below shows:

In addition to the tariffs mentioned above, a number of additional retaliatory tariffs are being considered pursuant to WTO dispute settlement actions. For example, those resulting from: recently initiated Section 301 investigations of digital services taxes imposed/proposed by Austria, Brazil, Czech Republic, the EU, India, Indonesia, Italy, Spain, Turkey and the United Kingdom; COVID-related trade restrictions; and the political situation in Hong Kong.

James Mendenhall concluded that a number of non-tariff actions may also impact European companies doing business in the U.S. (for example the Executive Order on Securing the Information and Communications Technology and Services Supply Chain).

These tariff and non-tariff measures will significantly affect supply chains by increasing costs, reducing access to materials, creating tremendous uncertainty–not only for trade but also for investment–and contributing to the creation of an unpredictable environment.

Professor Maxi Scherer of Queen Mary University of London; Special Counsel, WilmerHale (United Kingdom) addressed the legal effects that these measures have on commercial (and in particular supply-) contracts, as well as the current health crisis and its effects on contract performance.

While it may seem easier to prove force majeure during a pandemic, given that such clauses commonly include pandemics as examples of force majeure events, Professor Scherer explained that it is necessary to demonstrate its specific effects on the contract and its performance.

Emmanuel Jacomy, Partner at Shearman & Sterling (Beijing & Singapore), focused on the media aspect of the tariff wars, citing incendiary declarations made by President Trump and Chinese officials that illustrate the current unprecedented tension between the U.S. and China. As a result of these declarations and the measures taken by these two countries, both European and Chinese companies operating in Europe have found themselves in the middle of an environment highly conducive to investment disputes.

Similarly, following measures adopted as a result of the pandemic, governments in the U.S., China and Europe have implemented travel bans, essentially frozen non-essential business and construction projects, and have ordered the requisition of companies and production lines, in particular hotels, private hospitals and companies producing medical equipment, including companies owned by foreign investors. These measures could potentially give rise to claims for breaches of standards of fair and equitable treatment or expropriation.

Emmanuel Jacomy then discussed potential dispute concerns related to mandatory changes in private contracts implemented as a result of the pandemic. The arbitral tribunal would likely consider the following three factors when determining the success of these claims: (i) duration and impact: whether the investors have been adequately indemnified for their loss; (ii) transparency: whether the measures were applied in a transparent and predictable manner; and (iii) fairness: whether these measures were applied in a discriminatory manner favouring domestic companies or a certain category of investors.

These changes could provide an immense potential for claims, but seem unlikely to materialise in practice. He highlighted four reasons why: (i) there are few investment treaties between the EU and the U.S. For example, there are only 9 between the U.S. and the EU, and countries falling outside of these treaties will not be afforded protection; (ii) China has substantially more treaties in place, but older treaties provide inadequate or limited dispute resolution mechanisms; (iii) many of the treaties in place contain exception clauses, allowing for legitimate measures taken under the ambit of “public health”, “essential security”, “public order”, etc.; and (iv) there is a chilling effect in place. Claims against China and the U.S. are exceptionally rare, and the current trade war and health crisis are unlikely to convince investors to initiate new claims.

Second panel chaired by Patrick Thieffry, Independent Arbitrator addressed the topic of

“The European Green Deal and Climate Law: What is the impact on dispute resolution?”

Patrick Thieffry opened the session by referring participants to a primer on The European Green Deal, Climate Law and Arbitration which he prepared and distributed to all participants in advance, which included a summary of the European Commission’s communication about the European Green Deal (“EGD”), as well as snap shots of current arbitral practices in environmental and climate disputes.

He further stated that the EGD not only proposes contributing to the implementation of the Paris Agreement, but also proposes taking major environmental and climate legislation a step further, including on bio-diversity, circular economy, and even reaching a 0% pollution goal, all of which will impact businesses, giving rise to commercial and investment disputes.

The EGD has become even more relevant in the last three months, with a 7 billion EUR budget and a new invitation to arbitration practitioners to limit carbon emissions by using clean methods of dispute resolutions. Before concluding, Patrick Thieffry reminded everyone that the ICC Commission on Arbitration and ADR has recently released its Report on Resolving Climate Change Related Disputes through Arbitration and ADR, with two concrete results: (i) many types of climate change related disputes are expected to rise from all kinds of business investment and contracts, and (ii) the ICC is equipped to resolve such disputes in a quick and efficient manner.

Frances Lawson, Managing Associate at Orrick (Switzerland) added that the EGD is a game changer. She addressed the issue of the EGD impact on commercial contracts and mentioned three points: 1) key aspects of the EGD, 2) the types of changes, and 3) the scale of changes. She concluded that while the scale of the changes we are likely to see is extensive, the pace of change in the corporate world is typically slow.

She reflected on the mandatory rules upon which the EU may reinforce these measures and how the price of imports will reflect the changes. Non-EU products may need to be aligned accordingly. Emissions targets for states to help accelerate the decarburisation process are also provided. The support of the green sector and products will be necessary. New legislation supported by sustainable products and common methodology is promoted. The 2021 action plan calls for 0 emission in both water and soil.

Contracts will become more detailed and may include binding clauses providing that a certain percent of used materials are sourced from recycled products, and/or products produced using a certain % of renewable energy. Construction contracts may provide for the use of carbon-neutral products and processes. These changes are to be implemented over 25 years, to be attained by 2050.

Climate law is already making its way through the European Parliament and the European Council. By announcing the EGD, the EU has expressed its boldest and most ambitious plan to date to place climate change and protection at the heart of EU policy.

The question is: Do we want to be reactive, playing catch-up and making changes to the way we do business once we are left with no other choice? Or do we want to position ourselves at the head of the curve, looking forward and preparing for what lies ahead? The extent to which future contracts will reflect the EGD in the coming years depends on our answer to this question.

Patrick Baeten, General Counsel of Engie (Brazil), commented on what types of disputes may arise as a result of the implementation of the EGD and climate laws in France and Europe as a whole. The EGD represents a major shakeup of a substantial part of a global interconnected economy and will have major impact on states, corporations and citizens alike.

The EU Commission is aware of “the ecological transition” which will modify existing relationships and create new ones, as well as creating new rights. Shock events generate “business to business” opportunities. International public law references to climate protection are emerging, which would create new rights.

Finally, he referred to the emergence of what has been called “litigating for a change” where citizens and NGOs start or join strategic cases designed to pressure national governments to be more active or to enforce existing legislation.

In general, he concluded, we will see all types of disputes flourishing, including commercial disputes, ISDS, more administrative enforcement procedures and new civil rights disputes.

José Manuel Garcia Represa, Partner at Dechert (France) indicated that implementation of the EGD entails real risks of claims by investors under bilateral and multilateral treaties as a result of changes in environmental laws and dispute resolution. Investors, in particular, will be impacted. There is a tension between a state’s obligations to protect its population and territory against environmental harm and its obligations under various treaties to protect foreign investors against state interference, including for environmental motivations, however legitimate they may be. He questions which interest should prevail, and whether protecting the environment is simply a matter of national law.

EU member states may need to consider treaty reform, either denouncing or amending existing treaties, to mitigate the risk of claims arising from the implementation of the EGD and to avoid liability for environmental protection measures, but this will take time.

This panel finished with an informal poll of the audience about their expectations for the future, revealing that climate and environmental issues were a significant issue for a majority of the audience, and a willingness for changes related to the health crisis, such as going paperless and conducting virtual hearings, to be maintained post-health crisis.

More coverage from Paris Arbitration Week is available here.

________________________

To make sure you do not miss out on regular updates from the Kluwer Arbitration Blog, please subscribe here. To submit a proposal for a blog post, please consult our Editorial Guidelines.

References

| ↑1 | On 9 April 2020, the ICC published its Guidance Note on Possible Measures Aimed at Mitigating the Effects of the COVID-19 Pandemic previously discussed on the blog. |

|---|

Having attended both the sessions , i found it historical . Thanks ICC for affording an opportunity to connect globally.