The selection of an interest rate to apply to an arbitral damages award can be an important determinant of the total award. For example, prejudgment interest added 26% to damages across 63 ICSID awards since 2000. Consistent with this notion, many international investment treaties specify claimants be compensated at a reasonable or normal “commercial rate.” However, the lack of specificity in the definition of this rate leaves significant scope for arbitral discretion, and therefore the parties to a dispute may rely on expert opinions to support their particular positions. This imprecise definition requires an interpretation of what constitutes a normal “commercial rate,” either as the rate at which the claimant could have or did invest funds, or the rate at which the claimant could have or did borrow funds.

The importance of clearly defining a “commercial rate” is evident in data on corporate borrowing rates. Such rates show wide variation both over time and across the borrowers’ debt maturity, seniority, and credit risk. Past arbitral decisions have relied on various definitions of “commercial rate,” leaving significant scope for disagreements between the parties as to what constitutes an appropriate rate. We suggest a more empirical approach to help tribunals select a prejudgment interest rate that best comports with their interpretation of “commercial rate.”

In this post, we first describe the concept of “normal commercial rate,” and then examine how corporate debt interest rates vary through time as well as across debt and company characteristics.

Typical clauses for interest compensation in Bilateral Investment Treaties (BITs) define prejudgment interest as a “normal commercial rate.” This is the exact phrase used in BITs with Canada and the UK. Other variations of this phrase are a “commercially reasonable rate” (US or Japan), “appropriate market rate” (France), or “usual bank interest” (Germany). See the most recent model BIT treaties (where available) or recent bilateral treaties, from the UNCTAD BIT database here. Such definition leaves room for opinion on its precise meaning and measurement. For example, the following two cases illustrate two common interpretations:

- BG Group v. Argentina: “This Tribunal agrees with BG that interest at a reasonable commercial rate is appropriate… The rate of interest is a function of the instrument in which BG could have reasonably invested funds available to it… investment in a highly secure, dollar denominated, liquid and short-term instrument would have enabled BG to rapidly redeploy its funds.” (awarded interest at six month US Treasury rates).

- Tidewater v. Venezuela: “as the Treaty’s reference to ‘normal commercial rate’ underlines, it represents the cost of borrowing the sum that the claimant ought to have received over the same period of time. Thus, the appropriate reference point is the cost of borrowing available to Claimants.” (awarded interest at 4.5%).

The above examples of arbitral awards show a key issue in determining a “normal commercial rate:” whether that term refers to an investment or a borrowing rate. An investment rate interpretation is consistent with compensation for the opportunity cost of not being able to invest the award amount between the date of harm and the date of the award. Companies are able to invest at rates that run the full gamut of risk, from risk-free debt (e.g., purchase of US Treasury bills) to speculative debt (e.g., purchase of debts in default), to equity investments in specific projects or properties. This interpretation often leads to the selection of a risk-free or nearly risk-free rate (e.g., BG Group v. Argentina’s award of a “highly secure… liquid and short-term instrument”).

The borrowing rate interpretation is consistent with compensation for the claimant’s cost of capital, and, in some circumstances, compensation for being forced to borrow as a result of the alleged harm. A borrowing rate, however, depends on the characteristics of both the borrower and the terms of the loan. Tribunals are often hesitant to use a borrowing rate that is specific to the claimant’s cost of debt, often opting for borrowing rates of low credit risk, non-bank borrowers. For example, the tribunal in Joseph Charles Lemire v. Ukraine (March 28, 2011) eschewed LIBOR as an interbank rate, opting instead for LIBOR+2% as indicative of the higher rate banks would charge to their clients.

Several arbitral awards have referenced a benchmark such as LIBOR+2%, though such awards may be based more on precedent than any empirical assessment of typical commercial borrowing rates. (PSEG Global Inc., et al, v. Republic of Turkey; Sempra Energy International v. Argentine Republic; and Enron Corporation and Ponderosa Assets, LP v. Argentine Republic.) To the extent tribunals intend to award interest at a rate that reflects market conditions during the prejudgment interest time period, reliance on precedent presents a risk that the award would not, in fact, reflect such market conditions. We turn to some empirical data to illustrate this issue.

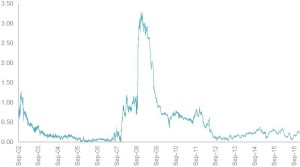

Figure 1 shows the spread of one-year A-rated corporate bonds over one-year LIBOR. This spread is the difference between the yield on one-year A-rated corporate bonds and the yield on one-year LIBOR. To the extent that an A-rated borrower is typical, A-rated borrowers typically pay rates that are much lower than LIBOR+2% and are frequently lower than LIBOR+0.5% if we put aside conditions observed at the height of the most recent financial crisis. The spread varies over time, even for a constant credit rating. This reflects changing market conditions, i.e., changes in the market’s willingness to accept lower returns for a given credit risk. Note that LIBOR is meant to represent the rate at which a group of banks could borrow funds in the interbank market. It is not necessarily the lowest possible commercial borrowing rate as, for example, a borrower may post collateral that makes the loan less risky than an interbank loan.

Figure 1: A-rated, one-year corporate bond spread to LIBOR

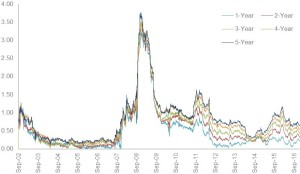

Figure 2 illustrates the A-rated corporate borrowing spread to LIBOR for annual maturities ranging from one to five years. Longer-term borrowing typically entails a higher spread. This maturity premium varies over time: the one-year and five-year spread are sometimes about 25 basis points apart, and sometimes over 100 basis points apart.

Figure 2: A-rated corporate bond spread to LIBOR, across maturities (1 to 5 years)

In other words, corporate debt rates are different for different debt maturities, and that difference in rates varies over time. Again, the spread to LIBOR is typically not 2%. To obtain spreads closer to 2%, one would need to consider a borrower of higher risk than A-rated borrowers. We examine this question next.

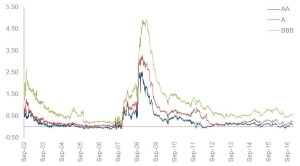

Figure 3 shows corporate bond spreads by credit rating (AA, A, and BBB). In addition to the time variation in borrowing costs, there are significant differences in borrowing rates as a function of issuer credit rating. The difference relative to LIBOR becomes quite large for riskier debts. Note also that the incremental borrowing cost of moving from AA-rated to A-rated debt is often smaller than the incremental borrowing cost of moving from A-rated to BBB-rated. These differences would become larger still when moving to credit ratings below investment grade. High yield or junk bonds have ratings below BBB.

Figure 3: One-year corporate bond spread to LIBOR, across ratings (AA to BBB)

The evidence above illustrates that borrowing rates vary over time with market conditions, as well as with debt maturity and credit rating. However, these are only a few of the factors that influence borrowing costs. Other factors include characteristics of the borrower and of the specific debt. Examples of borrower-specific factors affecting credit risks include: size of the company, profitability, consistency or volatility of the business, cash flows, and liquidity of assets. These factors may vary over time, across industries, and across firms within an industry. Debt-specific factors affecting borrowing rates include seniority in bankruptcy, security (collateral or other guarantees), and lender protection rights (e.g., debt covenants).

In conclusion, the selection of an interest rate for arbitral award damages can be an important determinant of the total award. In certain proceedings, tribunals are bound by treaty to award interest at a normal commercial rate. However, neither investment treaties nor award precedents provide clear guidance on how to define and measure a “commercial rate.” In addition to the fundamental question of whether such rates should reflect investment opportunity costs or claimant borrowing rates, there is also the important question as to how to benchmark the appropriate rate (particularly under the borrowing rate definition).

The benchmarks for corporate borrowing rates differ significantly over time, as well as with different borrower and debt-specific characteristics. To assist tribunals in selection of appropriate interest rates in arbitral disputes, claimants and respondents can provide more detailed empirical data. Such data might show corporate borrowing rates for the relevant period of time as well as display information or expert opinions substantiating why any particular rate should be preferred as typical or reasonable given the case’s specific circumstances.

The views expressed herein are the views and opinions of the authors and do not reflect or represent the views of Charles River Associates or any of the organizations with which the authors are affiliated.

________________________

To make sure you do not miss out on regular updates from the Kluwer Arbitration Blog, please subscribe here. To submit a proposal for a blog post, please consult our Editorial Guidelines.