The 18th Annual ITA-ASIL Conference, hosted virtually for a half-day on March 23, 2021, discussed ongoing efforts at ICSID and UNCITRAL Working Group III to reform investment arbitration.

José Alvarez (New York University School of Law) kicked off the conference by throwing down the gauntlet: procedural reform does not go far enough. In the long run, he argued, today’s ISDS reform efforts will not lead to the stable investment regime that reformers are seeking. The remaining speakers – one panel featured three arbitral institutions, UNCITRAL, ICSID and the ICC, and another featured chairs or advisors to national delegations to UNCITRAL Working Group III – largely defended the ongoing reform efforts.

Conference co-chairs Laurence Boisson de Chazournes (University of Geneva) and Patrick Pearsall (Allen & Overy) led the event, which featured as speakers Joseph Neuhaus (Sullivan & Cromwell), Catherine Amirfar (Debevoise & Plimpton), José Alvarez, Anna Joubin-Bret (UNCITRAL), Meg Kinnear (ICSID), Alexander Fessas (ICC), Colin Brown (EU delegation to UNCITRAL Working Group III), Makane Mbengue (University of Geneva), Ana María Ordoñez Puentes (Colombian delegation to UNCITRAL Working Group III), Jeremy Sharpe (US delegation to UNCITRAL Working Group III, speaking in his personal capacity) and Chiara Giorgetti (University of Richmond School of Law).

Alvarez: Current ISDS reform efforts will not lead to the stable investment regime that reformers are seeking

The debates about reforming ISDS began with two crises of legitimacy: Why do we have ISDS? And why is ISDS so lawless? Alvarez differentiated between the broad legitimacy crisis, which focuses on the very existence of investment treaties and their substantive provisions, and the reform efforts ongoing at ICSID, UNCTAD and UNCITRAL, which focus on how to make dispute settlement under investment treaties more subject to the rule of law.

On the one hand, scholars are questioning many fundamental premises of the ISDS regime – Do foreign investors really face an obsolescing bargain? Do they still face a liability of foreignness that requires protecting them from national courts? If investment treaties really attract foreign investment, why don’t CEOs venturing abroad or their political risk insurers think about them? Why do States need treaties to attract investments that make no contribution to economic development? Why should investment treaties go against basic concepts of private law such as national laws on corporations? Do we still believe that ISDS depoliticizes disputes?

On the other hand, the reform processes have zeroed in on one bugbear: dispute settlement procedure. Their agenda is concerned with issues such as long and expensive proceedings, non-diverse and biased arbitrators, inconsistent case law, and the lack of a mechanism to correct errors. Beyond the proposal to establish an assistance mechanism to level the playing field for richer and poorer States – easier said than done, said Alvarez – he noted that there are five possible directions for current ISDS reform efforts, none of which has the potential to displace existing ISDS:

- Replacement of ISDS provisions with non-binding dispute settlement or State-to-State dispute settlement, which would constitute a de facto return to national courts eg. Brazil’s Cooperation and Facilitation Agreements, US-Mexico-Canada Agreement (as applied to Canada), EU-China Investment Agreement, EU-UK Trade and Cooperation Agreement;

- Constrained ISDS, e.g., the US-Mexico-Canada Agreement (as applied to Mexico) and India Model BIT of 2016, which imposes a long exhaustion of remedies requirement;

- Reformed ISDS, e.g., the U.S. Model BIT of 2012, which includes an appellate mechanism, and Comprehensive and Progressive Agreement for Trans-Pacific Partnership, which accepts certain State counterclaims;

- Judicialization, e.g., the European Union’s proposal for a multilateral investment court, which is included in the EU-Canada Comprehensive Economic and Trade Agreement, and the EU-Singapore and EU-Vietnam BITs (see here for Alvarez’s detailed critique); and

- All of the above. At UNCITRAL Working Group III, some argue that States should have maximum flexibility to match their investment treaties to a full menu of dispute settlement solutions, using the Mauritius Convention on Transparency as a model. For example, a State could decide to maintain a traditional formulation of the FET standard, but replace binding arbitration with nonbinding mediation.

Either these options will not appeal to States and foreign investors, or their piecemeal adoption will not form a serious threat to the existing network of IIAs and the claims that continue to be brought under traditional agreements. A multilateral investment court tasked with interpreting different treaties in different cases cannot be expected to harmonize its jurisprudence without running afoul of the Vienna Convention on the Law of Treaties, for example. The more likely result is an even more complex international investment regime, with diverse substantive standards and diverse procedures for adjudication. Such diversity will not produce the predictable, consistent and stable rules that the reformers are seeking.

Instead, reformers are letting a good crisis go to waste. By focusing only on fixing dispute settlement procedures, they ignore the larger critiques that are undermining confidence in the investment regime writ large. The regime is under attack because the expected benefits of international investment agreements have not materialized as clearly as have the massive claims and subsequent awards against States. Yet ISDS reformers (and their critics) tinker at the edges and dodge the core question: If the end is increasing needed capital flows to the developing world, does the investment regime live up to its promise of being the means?

Arbitral institutions: The reform processes are focused on delivering tangible solutions

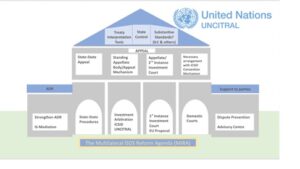

Anna Joubin-Bret contested Alvarez’s claim that UNCITRAL Working Group III would contribute to further complexification of the investment regime. Instead, the goal of the Working Group’s efforts is to build a structure resembling a house (see figure 1). Investors can enter the house through their choice of door – State-to-State procedures, investment arbitration, a multilateral investment court, or domestic courts. Any dispute may go to a second level appellate mechanism, which constitutes the biggest change to the existing regime. Each ‘door’ will have a corresponding second level, for example, investment arbitrations will have access to a standing appellate body, whereas disputes that enter through the investment court will have access to a second-instance appellate tribunal. The roof of the building represents State control over the process – about 120 States participate in each session of the Working Group – along with their desire to ensure coherence among treaty interpretation tools and substantive standards, the latter of which Joubin-Bret acknowledged is an issue “for a later stage.” Finally, two annexes to the house represent efforts to support parties in disputes and strengthen ADR and investor-state mediation. Extending the metaphor, Joubin-Bret presented the internal ‘floor plan’ of the house as the suite of procedural provisions that States can select. The “delivery mechanism” will be a multilateral convention that sits on top of the web of existing investment treaties, drawing from the experience of the Mauritius Convention on Transparency and OECD/G20 Base Erosion and Profit Shifting (BEPS) Project. This house, Joubin-Bret argued, is a coherent system that will ensure delivery of meaningful and long-lasting reform. Meg Kinnear argued that ICSID’s role is not to revise the substance of investment treaties, since ICSID is a procedural mechanism for facilitating dispute resolution. ICSID makes no apologies about focusing on procedural reform only. Its goal is to improve clarity, simplicity, and ease of use of dispute settlement procedures. She encouraged critics to view procedural and “architectural” reform as a step on the way to substantive reform, which may include paring back the treaties but may also include broadening them to include human rights or environmental obligations.

Figure 1: Slide from Joubin-Bret’s presentation on reform efforts at UNCITRAL Working Group III

Kinnear focused on tangible deliverables of the ICSID reform efforts. The current round of amendments to the ICSID Rules, which began in October 2016, was expected to have a final round of in-person consultations in March 2020 which were delayed by the COVID-19 pandemic. ICSID is keen to finalize the process and release the Revised Rules within the next year. The primary goal of the amendments is to shorten case times. Changes to the ICSID Additional Facility Rules will make the Additional Facility available when both disputants are not ICSID member states and will also allow regional economic integration organizations (REIOs) to act as disputants. Finally, ICSID and UNCITRAL released second version of the draft Code of Conduct for Adjudicators in International Investment Disputes on April 19, 2021.

Alexander G. Fessas planted a flag for even further procedural reform. The emerging divide between disputes of low-value and low-complexity disputes and disputes of high-value and high-complexity disputes, he argued, underscores the need to consider automation and other creative technological solutions. The proliferation of expedited arbitration for low-value, low-complexity disputes is a symptom of the demand for simple and fast dispute settlement options. The adoption of expedited arbitration among the package of reforms by other arbitral institutions demonstrates that it has passed the test of experience. The next frontier is online dispute resolution (Fessas recommended the work of Richard Susskind on online courts).

Perspectives from UNCITRAL Working Group III: States want fewer treaty claims, but many are not ready to abandon ISDS altogether

Ana María Ordoñez Puentes, chair of the Colombian delegation, said the goal is reform that produces the fastest possible effects without incentivizing investors to initiate even more arbitrations, particularly on frivolous claims. ISDS is an exceptional prerogative that Colombia grants to the foreign investments it wants to attract, but investors should only use it when there is an actual breach of the investment protection standards.

Makane Mbengue, who served as advisor to several African delegations, invoked the process of drafting the Pan-African Investment Code as a counterexample to Alvarez’s argument, where substantive reform was undertaken successfully, but adoption efforts were stymied by insufficient procedural reform. Today, there remains divergence between African countries on ISDS. States of the Southern African Development Community Region favor eliminating ISDS and returning to State-to-State dispute settlement, other states favor reforming ISDS in the mold of the Morocco-Nigeria BIT, and others yet support conducting dispute settlement before regional African courts or establishing a permanent African investment court.

Broadly, African countries are interested in turning ISDS into a dispute prevention tool alongside alternative dispute resolution mechanisms, but not in abandoning ISDS altogether. In November 2020, the African Union adopted a ministerial declaration on the risks of investor-state arbitration with respect to COVID-19 measures. The original proposal was for a moratorium on ISDS in Africa, but most AU Member States did not support sending a signal that Africa was opting out of ISDS. Instead, they opted to call for cooperation to mitigate the risks faced by countries implementing COVID-19 related measures. Efforts to establish a “culture of investment arbitration at the grassroots,” such as establishing an ICSID Center in Africa, are the path forward for ISDS in the region.

However, African countries are moving from the language of “investment protection” to “investment facilitation,” for example in negotiations for the Investment Protocol to the African Continental Free Trade Area. This signals a shift in prevalent understandings of the purposes of ISDS: Unlike mere protection, facilitation is win-win-win for home States, host States and foreign investors. Colin Brown argued that while the EU is witnessing more activity around “investment liberalization,” e.g., the EU-China Comprehensive Agreement on Investment, there remains an important role for treaties to play in investment protection.

Perspectives from UNCITRAL Working Group III: The UNCITRAL process holds the key to any future reform

Colin Brown, chair of the EU delegation to UNCITRAL Working Group III, said the working group has a “once-in-a-lifetime opportunity” to construct a framework for adjusting the 3000-odd investment treaties in existence. UNCITRAL Working Group III is the first multilateral process to holistically examine ISDS and the larger investment regime. Properly managing the process can create a framework that will structure reform efforts by future generations of investment policy makers.

The substantive rules of investment law are regarded as problematic because there is no permanent body to determine their content, he argued. Many of the questions being asked now about the investment regime were being asked about the GATT in 1980s. Negotiators largely did not change the substantive rules, but created a permanent appellate mechanism – the WTO Appellate Body – which provided the stability of authoritative interpretations. The EU is similarly focused on creating a permanent mechanism for investment law.

Jeremy Sharpe, speaking in his personal capacity, described the Working Group III discussions as a “nascent institution”: a forum for states to discuss common problems which is already a big improvement over the decentralized existing investment system. National delegations, he argued, are already implementing lessons learned from the Working Group discussions domestically. The proposed advisory center could play a similar institutional role for States to discuss issues such as best practices and capacity building. Such domestic and international “institutionalization” is the fundamental building block to dealing with any further reform, including substantive reform.

________________________

To make sure you do not miss out on regular updates from the Kluwer Arbitration Blog, please subscribe here. To submit a proposal for a blog post, please consult our Editorial Guidelines.