Considering the many ongoing discussions, especially in academia, on the perceived shortcomings, evils and presumable demise of Investor-state Dispute Settlement (ISDS), it is sometimes easy to forget that the system is alive and kicking and we should not be throwing in the towel just yet. Thankfully, last month ICSID published its Annual Report for the 2022 financial year, illustrating the sheer volume of developments in international investment law, and providing a more nuanced (or dare one say, balanced) picture of ISDS.

This post summarises the already accessible Report and provides a comparative overview of the figures by contrasting the numbers to the statistics from 2021 to 2018.

1. New and Administered Cases

In FY2022, ICSID registered 50 new cases which, while a drop from the 70 registered in FY2021, is still very much in line with the statistics from recent years (FY2020 – 40, FY2019 – 52, FY2018 – 57). FY2022 marked a year-on-year increase in a number of administered cases – 346, up from 332 in FY2021 (FY2020 – 303, FY2019 – 306, FY2018 – 279). Overall, the total number of cases administered by ICSID now stands at a respectable 888. As in previous years, the ICSID Secretariat also administered a smaller number of non-ICSID cases (mostly under the UNCITRAL Rules and other ad hoc rules).

2. Jurisdiction

In FY2022, the majority (56%) of cases were brought under bilateral investment treaties (BITs) (FY2021 – 63%, FY2020 – 57%, 2019 – 64%, 2018 – 60%). There was a slight increase (of +3%) of cases brought under the Energy Charter Treaty (11%), though this proportion is still lower than in FY2020 (16%). In this regard, commentators have remarked that this increase will continue in light of news regarding the ECT modernisation process (see analysis here and here). While the vast majority of remaining cases have been brought under various multilateral investment agreement (MITs), an often-overlooked proportion invokes jurisdiction derived from an investment contract. This number has been in or close to double digits for years now, indeed in FY2022 it edged over the ECT again (FY2022 – 13%, FY2021 – 7%, FY2020 – 11%, FY2019 – 15%, FY2018 – 14%). Again, commentators have candidly started to make note of this development and its potential increase in the future.

3. Geographical Distribution of Cases

There have been slight shifts in the distribution of cases throughout the past 5 years without many clear trends emerging. Some commentators have suggested that the EU’s decision to ban intra-EU ISDS may produce dips in the number of cases. The numbers do not appear (not yet at least) to reflect this impact. Firstly, most of the intra-EU BITs were terminated in 2021 following the Court of Justice of the European Union’s ruling in Achmea and as such the reporting period for this report has likely been less impacted by these developments than might in future years. Secondly, the proportion of new cases registered in “Western Europe” has always been rather low (FY2018 – 4%, FY2019 – 10%, FY2020 – 13%, FY2021 – 10%, and this year – 8%). It ought to be noted, however, that ICSID categorises States such as the Czech Republic and Lithuania, both EU Member States, under “Eastern Europe & Central Asia”. This means that without a much deeper dive into the statistics, it is difficult to say what the impact the EU’s decision in banning intra-EU arbitration has had on ISDS in Europe.

Speaking of the Eastern European & Central Asia region, while in FY2018 it was responsible for 40% of new registered cases, this number has been on the decline (though not consistently) for years and is now at 20%. Perhaps the most visible trend is the growth of cases registered in “Central America & the Caribbean”, which now stands at 12%. South America was the largest singular region in FY2022, responsible for 22% of new cases, up from 14% in FY2021, but still down on its record of 32% in FY2020. Again, other regions have been rather consistent throughout the years. Of those not yet mentioned, in FY2022, Middle East & North Africa accounted for 12% of new cases, Sub-Saharan Africa for an additional 12%, South & East Asia & the Pacific for 8% and North America (including Mexico) for the final 6%.

4. Subject Matter: Economic Sectors

The economic sectors involved in ICSID proceedings are diverse. In the past five years, each Annual Report outlined at least nine categories of economic sectors, with Oil, Gas & Mining, Electric Power & Other Energy, and Construction consistently being the biggest three. Other sectors include information communications technology (ITC), Tourism, Transportation, Finance, Agriculture, among others.

In FY2022, a proportion of cases stemming from disputes involving Electric Power & Other Energy (24%), has for the first time surpassed that of Oil, Gas & Mining (22%). The former has also reached its highest level, while the latter came down from 30% in FY2020 and 29% in FY2021. This steady increase in disputes involving areas such as renewable energy should come as no surprise to observers. The growth in ISDS cases involving Electric Power & Other Energy, should be welcomed, showing not only that the sector is maturing, but also that international investment law protects not just the “evil” corporations but perhaps also the “good guys”… or at least the guys we come to really need at this point for energy transition.

5. Outcomes

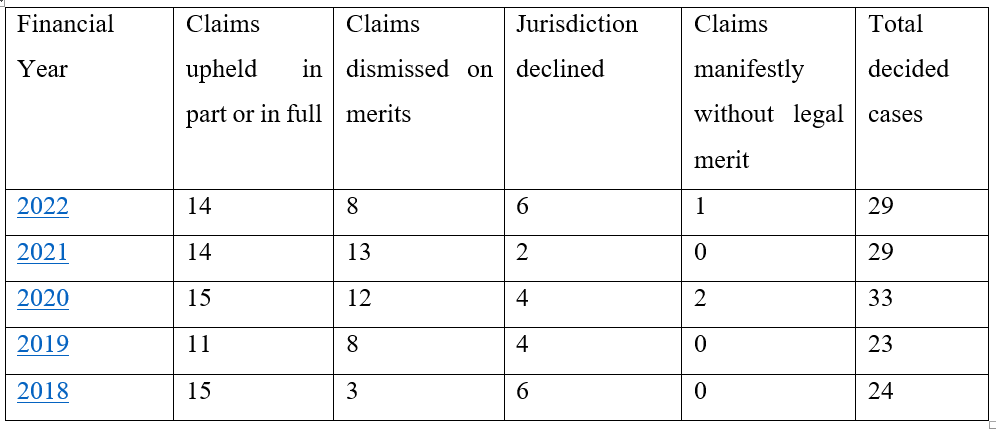

As always, the statistics on outcomes prove possibly the most interesting read. ICSID reports that in FY2022, 29 cases were decided and a further 27 cases were settled or discontinued.

In its 2022 ICSID Caseload Statistics report (Issue 2022-2), ICSID explains that within the 27 cases settled or discontinued, 48% were settled at the request of both parties, 30% at the request of one party (under ICSID Arbitration Rule 44 and Additional Facility Rule 50), 18% were discontinued for lack of payment and in the remaining 4% of cases, settlement agreement was embodied in the award.

Regarding the 29 decided cases, in 14 of them the tribunals upheld claims in part or in full, and in 15 they decided in favour of the respondents (in eight cases all claims were dismissed, in six tribunals declined jurisdiction, and in one case the Tribunal dismissed the claim for being manifestly without legal merit). As shown below, this trend, which slightly favours the States, reflects previous years’ trends, with the small exception of FY2018. These numbers are particularly interesting when taken in view of increasing calls for the abandonment of the ISDS system as one that seemingly unproportionally favours the investor.

Finally, as in most previous years, in 2022 all the annulment proceedings have been unsuccessful. In the 17 annulment proceedings concluded in FY2022, the ad hoc committees rejected the applications on 14 occasions, while the remaining cases were discontinued. Again, this marks consistency in ICSID proceedings, as in previous year ad hoc committees have only annulled an award (once partially in FY2021, once in FY2020, once partially in FY2019).

6.Tribunal Appointments

Lack of diversity is an ongoing issue in ISDS. In the 2021 International Arbitration Survey, while more than half of the surveyed agreed that some progress has been made in terms of gender diversity, less than a third believed this to be true in respect of geographic, age, cultural and, particularly, ethnic diversity. While the ICSID Annual Reports do not consider ethnicity in their statistics, they do report on geographic distribution of appointments by ICSID and the parties. Thus, in FY2022, 182 appointments were made to ICSID tribunals, commissions and ad hoc committees whereby individuals of 42 nationalities were represented (in FY2020 it reached a higher number, at 44). Notably, however, despite a growing number of cases, each year the proportion of first-time appointments remain rather low: in FY2022 and FY2021 – 11%, FY2020 and FY2019 – 15% and FY2018 – 17%. Perhaps, the words by Jan Paulsson in 2010 still ring true today: “boasting of a constant stream of new entrants’ fools no one acquainted with the field.”

While the numbers remain disappointing, ICSID itself actually plays a leading role in changing the status quo. Thus, for example, while women accounted for 24% of all appointments made to ICSID cases in FY2022 (FY2021 – 31%, FY2020 – 14%, FY2019 – 24%, FY2018 – 24%), 55% of them were appointed by ICSID. This is indeed in line with previous years where ICSID also tended to appoint most female appointees, followed usually by respondents, joint decisions of parties combined with co-arbitrators and then, often trailing behind, by claimants. Perhaps the Secretariat’s own consistent experience in having staff consisting of 24 nationalities with fluency in 25 languages, and of which 75% are women, plays a role in its visible commitment to diversity.

7. New Parties

ICSID prides itself in its wide and large membership. Indeed, in FY2022, ICSID welcomed its 156th and 157th Member State (by end of FY2022, ICSID numbered 164 signatories to the Convention). First to deposit its Instrument of Ratification in the latest financial year, was Ecuador which did so in August 2021, re-joining ICSID after previously denouncing the ICSID Convention in July 2009 (see here). Kyrgyz Republic followed in April 2022, 27 years after signing the Convention. In the last five years, two more States became signatories of the Convention: Djibouti in FY2020 and Mexico in FY2019. Notably, as of 21 September 2022, the ICSID Convention has one more Contracting Party – Angola, who signed the Convention in July 2022.

8. Spotlight, Outreach and Outlook

The final parts of each Annual Report include the overview of ICSID publications and official documents, reports of annual meetings and independent auditors’ report (FY2022-2019 prepared by Deloitte, FY2018 by KPMG). Each year ICSID also choses a theme which it puts in a “Spotlight”. Thus, in FY2018 the spotlight was on the ICSID Rules Amendment Process, which subsequently resulted in the topic of FY2022 spotlight: 2022 ICSID Rules and Regulations (for analysis see here). Throughout the years, other spotlights included Mediation (FY2021) and Technology (FY2020).

Finally, perhaps the most pleasant-to-read part of the Annual Report concerns the Centre’s Outreach and Training activities, highlighting events, training sessions and speaking engagements undertaken by the ICSID representatives in each financial year.

If any conclusions can be drawn from the last five Annual Report, they must touch upon ICSID’s consistency and professionalism, as well as upon the continuing popularity of ISDS system amongst claimants, and the strong position of the State within this system. While some Contracting Parties, or at the very least some representatives of those Parties, may have recently developed negative attitude towards ISDS, the numbers do not lie. In addition, if the Reports show us anything, is that perhaps the future of ISDS is not as morbid as some would say (or hope).

________________________

To make sure you do not miss out on regular updates from the Kluwer Arbitration Blog, please subscribe here. To submit a proposal for a blog post, please consult our Editorial Guidelines.

The pdf icon is returning a ‘critical error’, the last couple of days. Can you pls fix it. THanks

Thank you, Tania. We are working to fix this. Best wishes, KAB