The past year has seen a variety of exogenous impacts to global energy markets: from the sanctions flowing from Russia’s “special military operation” in Ukraine, to the supply chain aftershocks of the COVID Pandemic, to hiccups in the commercial and government policy implementations of the global Energy Transition. International arbitration too has seen its share of tremors in recent years. By way of example, the 2021 QMUL survey touched on the need to adopt greener arbitration practices following the COVID pandemic’s shake up of global workplace arrangement. Sitting as we are between an untenable past, an uneasy present, and an unknown future for both the energy industry and international arbitration as a practice, the results of the 2023 Queen Mary University of London (QMUL) – Pinsent Masons Future of Energy Arbitration Survey could not arrive at a timelier juncture. Since 2005, QMUL has established a tradition of crafting surveys that meld corporate insights, industry-specific knowledge, and topical themata into a readily digestible, quantitative format. This year’s (thirteenth) iteration of the survey is no exception. Its key findings are detailed below.

I. Price Volatility, Sanctions, and Supply Chain issues

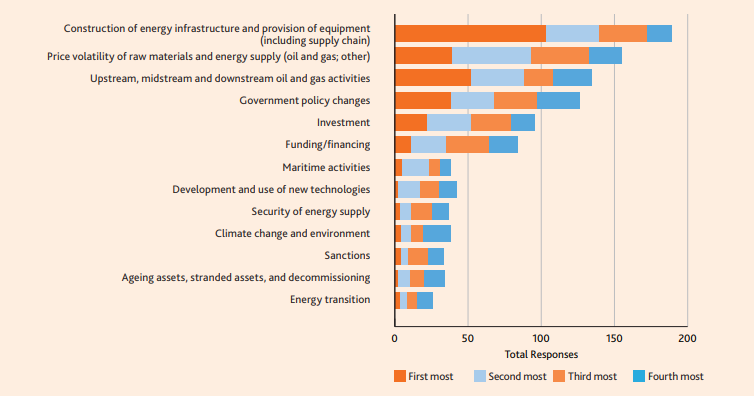

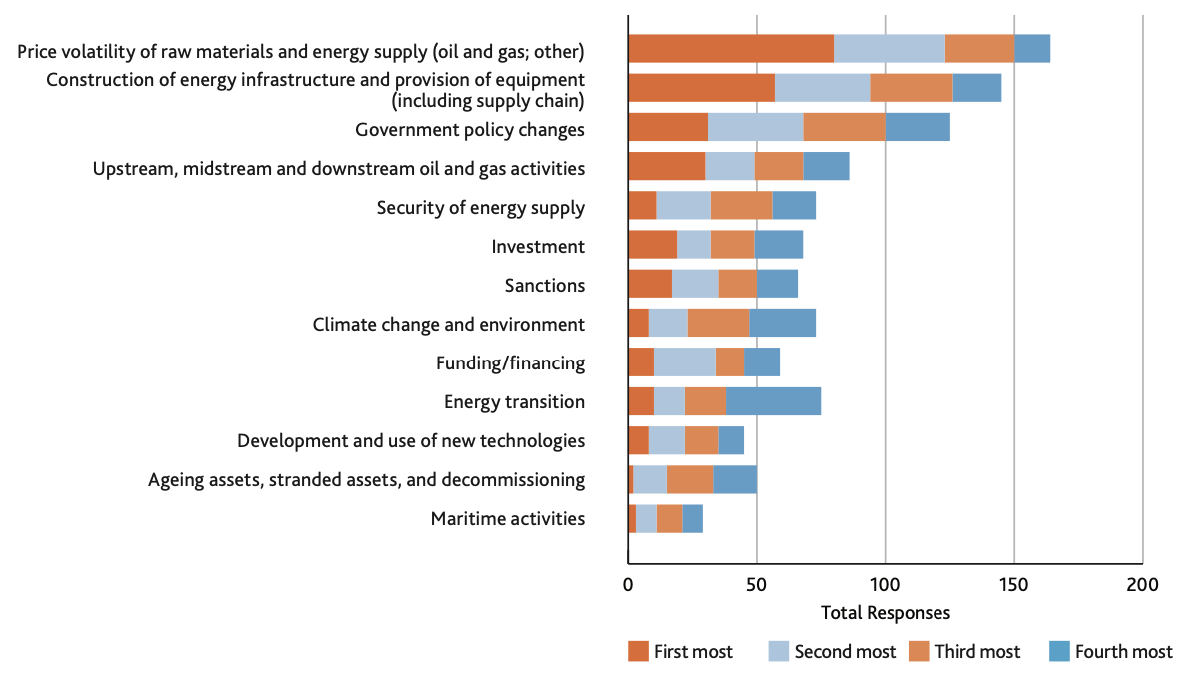

The first substantive section of the survey asked respondents to draw on their experience to forecast the key drivers of energy disputes in the short to medium term. Unsurprisingly, the results we gathered here mirror, to a large extent, geopolitical realities at the time of publication. For example, the survey revealed that price shocks are causing concern amongst energy arbitration professionals, with approximately twice as many respondents choosing price volatility as the leading cause of disputes over the next five years as for the past five.

![]()

![]()

Respondents also indicated that sanctions are having a significant impact on the contractual performance of energy projects. Most respondents (67%) thought that sanctions would affect a rise in force majeure and hardship claims under existing contracts. An equally high number (67%) noted that they have seen an increase, and expect to see a continued increase, in suspensions and terminations of energy projects due to sanctions. The impact of sanctions carries over well beyond the scope of specifically included companies. Because of the network of entities required to finance and perform large-scale, complex energy projects, many companies are cutting ties with all Russian counterparties, not just those immediately covered by global sanctions regimes. This dynamic, overlayed with the scope of terminations and suspensions uncovered by our data, is certain to generate a wealth of new commercial law precedents over the next few years.

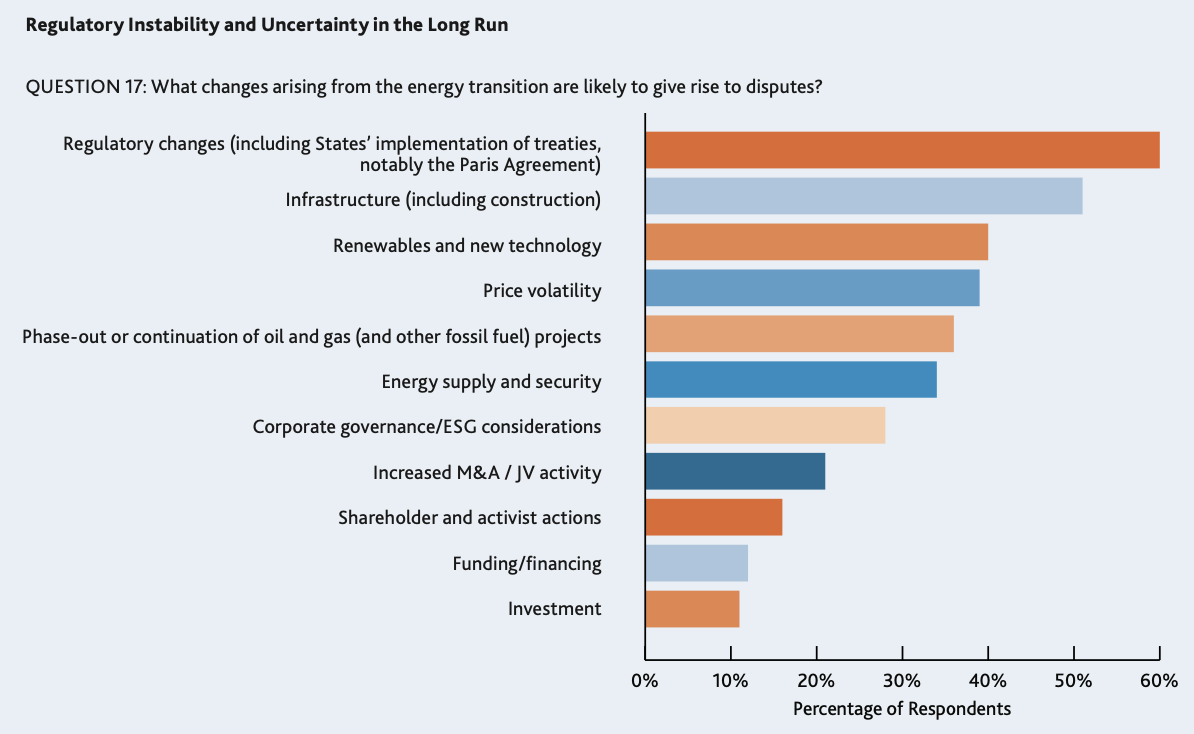

Finally, several respondents noted that energy supply and security issues triggered by Russia’s invasion of Ukraine will likely set back the timeframe for the transition away from fossil fuels, by a decade if not longer. The general attitude of respondents towards the commercial viability of renewables, in general, was surprisingly tepid. Most did not view the energy transition or renewables disputes as a significant source of concern in the short to medium term, but rather, an issue that would fit more squarely in a ten-plus year horizon.

II. Arbitration as an ADR Mechanism

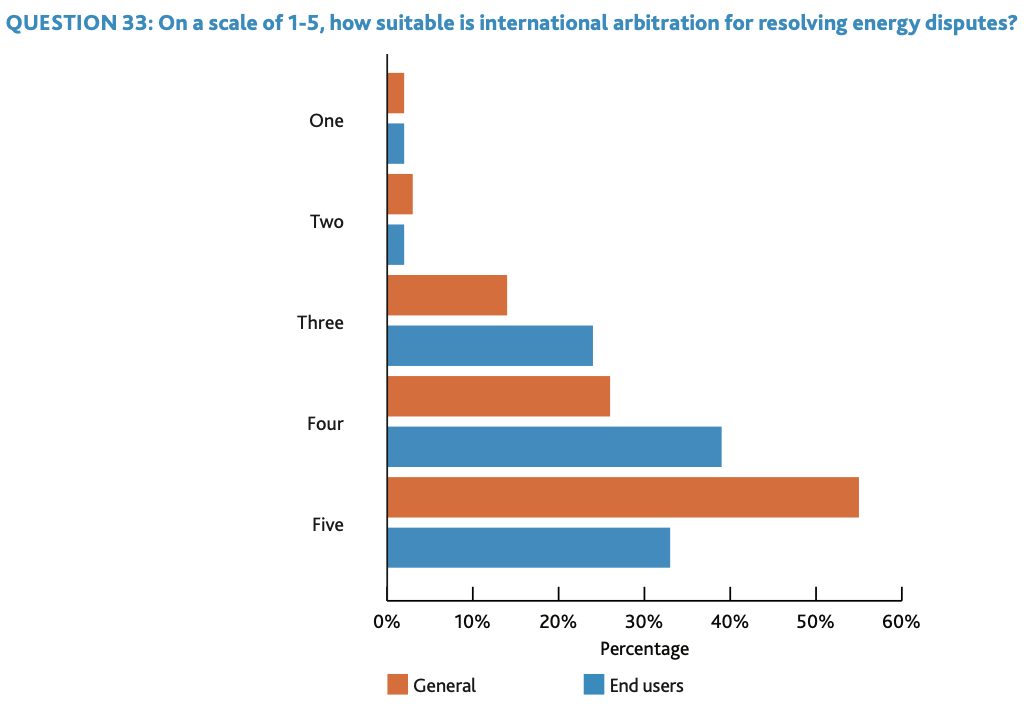

The QMUL survey has its genesis in the attempt to understand corporate attitudes and choices around arbitration. In fact, the project only began including feedback from arbitration practitioners in 2012. This year’s survey made a point of disaggregating the views of “end users” (inhouse counsel, business executives, and State and SOE representatives) from the general population of respondents. This revealed that enthusiasm for arbitration amongst this key demographic was high but tempered by a desire for increased procedural efficiencies.

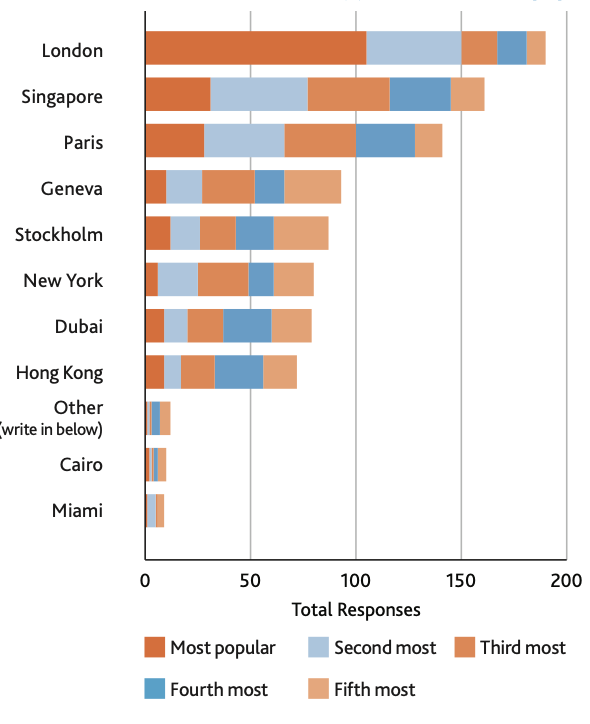

Once again, London ran away as the most popular seat for international arbitrations with 49% of respondents selecting it as their first choice of arbitral seat. Several respondents noted that the stability of London’s commercial law made it a particularly favourable destination for arbitration of energy disputes.

![]()

III. Third-Party Funding and Green Arbitration

As mentioned above, the 2021 Queen Mary Survey on adapting arbitration to a changing world recorded opinions and practices regarding a variety of measures to reduce the environmental impact of international arbitration. This year, respondents were asked which measures highlighted by the Campaign for Greener Arbitrations they were implementing in their practice to help mitigate the impacts of arbitration on climate change. The most popular responses were: (i) the use of videoconferencing for meetings and hearings (81%); (ii) avoiding unnecessary travel, particularly flights (69%); and (iii) greater use of electronic bundles at hearings (66%). However, 52% of respondents indicated that green arbitration credentials would not impact their choice of arbitral service providers and of the 48% who noted it would make an impact, most commented that it was very low or at the bottom of their list of priorities when choosing arbitral service providers. What explains this disconnect? A cynical interpretation might be that this “business as usual” approach indicates a lack of concern among respondents about arbitration’s impact on climate change. However, it may equally be the case that the increased cost efficiencies brought on by green arbitration measures have become so commonplace so as not to register as a discernible difference between service providers. Indeed, some respondents indicated in interviews that they viewed green measures as inextricably linked with efficiency in the arbitral process. So, it may just be that the results of the survey do not so much represent a failure of arbitration to move past the “business as usual” approach, as an evolution of the “business as usual” approach itself as we move into the post-COVID era.

An overwhelming majority of respondents (84%) also thought that third-party funding of energy disputes would significantly increase in the next five years. When asked to specify which types of energy disputes would see the largest share of funding, 61% of respondents selected energy infrastructure and 46% selected investor-State disputes. Some funders noted that climate change disputes will become an area to watch as climate damages become more readily quantifiable, giving activist investment an opportunity to enter the funding arena.

IV. ISDS

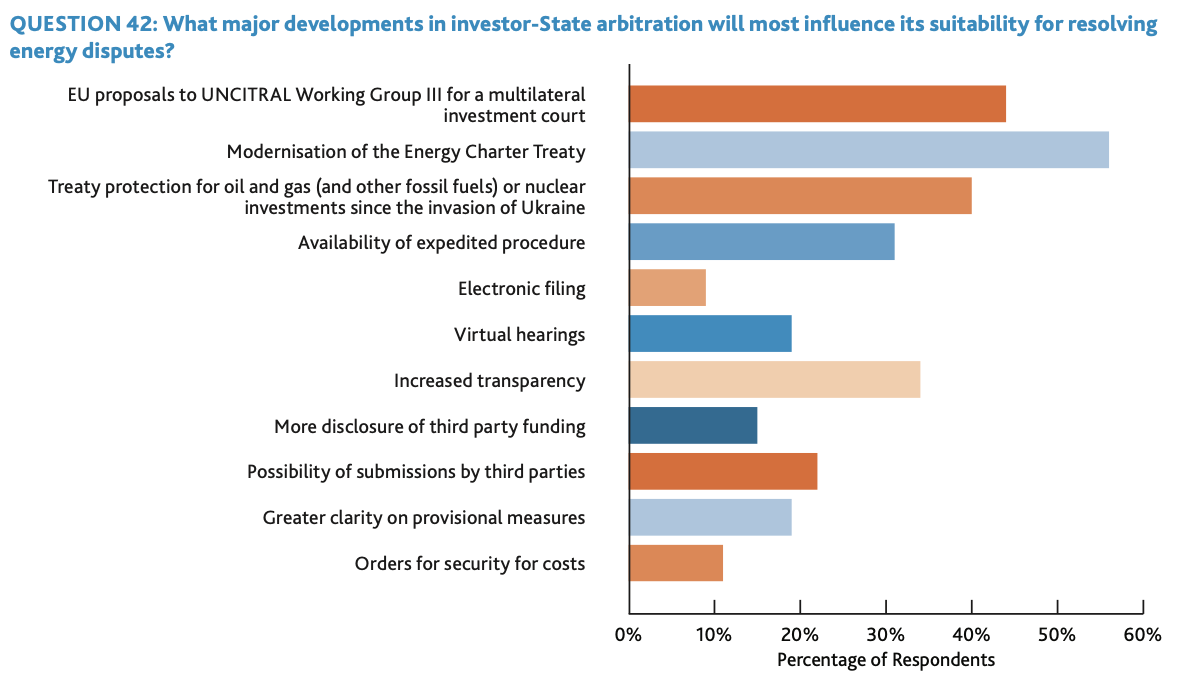

It is also intriguing to record that oil and gas investments continue to make up the largest proportion of investment arbitrations seen by survey respondents; this is in contrast to the known Energy Charter Treaty (ECT) cases, the vast majority of which relates to renewable energy sources. The respondents consider the avoidance of litigation before national courts as the main reason for investor-state dispute settlement (ISDS) by arbitration (80%) while enforceability of awards also ranks very highly (70%). The respondents also posited on the challenges facing ISDS. While globally the termination of intra-EU BITS seems to be a marginal issue among respondents (34%), this number is markedly higher (54%) when one looks at European responses. Nearly 60% of the respondents consider the modernisation of the ECT as the most significant development, followed by EU proposals to UNCITRAL Working Group III for a multilateral investment court, which received votes from slightly less than 50% of respondents.

V. Concluding Remarks

This year’s survey enjoyed robust participation, with over 900 recorded responses to the questionnaire and 50 one-to-one qualitative interviews conducted. These results are a testament both to the importance of the survey to the evolution of international arbitration and the importance of the evolution of arbitration to its stakeholders. The survey also represented an opportunity to take a snapshot of the energy industry at a particularly important inflection point. As the geopolitical reference points utilized by the survey continue to mature and to shape global energy disputes in months and years to come, the data collected here can serve as a useful measuring stick by which to judge the efficacy of the discourse between the global energy industry and the global arbitration community. We hope the survey will be utilized as such as we continue to weather the shocks of COVID, Russia’s invasion of Ukraine, and the uneven implementation of the global Energy Transition.

________________________

To make sure you do not miss out on regular updates from the Kluwer Arbitration Blog, please subscribe here. To submit a proposal for a blog post, please consult our Editorial Guidelines.