The energy transition lies at the heart of climate change mitigation efforts. A new survey by Queen Mary University of London (QMUL) in collaboration with Pinsent Masons, the Future of International Energy Arbitration Survey Report, (“the Energy Report” or “the 2022 QMUL Survey”) (see also here) offers guidance to anticipate and mitigate those risks for companies and counsel participating in energy transition projects.

This latest in the series of QMUL surveys was conducted from May to October 2022, during a tumultuous period for the global economy and especially the energy sector, rocked by the war in Ukraine, and as arbitration practices were continuing to evolve as a result of the Covid pandemic. The survey focused less on party preferences for arbitration vs other forms of resolution and more on how they presently use it and what could be improved for energy disputes. It considered the types of disputes most likely to increase due to climate change and the energy transition, and the commercial realities respondents themselves face from the challenges of achieving a net zero transition.

The timing is optimal given the long lead-time for many energy projects. These often begin with feasibility studies and government permits, followed by negotiations and then contracts signed with financing organizations, suppliers of technology, equipment, construction works, etc. For disputes that will make their way into the courts and arbitration institutions around the world in the coming years, the time for planning is now.

Building New Energy Infrastructure while Deploying New Technologies: A Recipe for Disputes

The ambitious needs and goals to reduce current dependency on carbon-emitting energy sources require even more ambitious investments in new technology and infrastructure. The 2015 Paris Agreement explains the need to act to reduce greenhouse gas emissions to limit global average temperature rise to 1.5°C. From the UNFCCC and other sources we learn that to stay on the safe side of this planetary boundary, global emissions need to reach net zero by 2050. Net zero means cutting greenhouse gas emissions to as close to zero as possible, while remaining emissions are re-absorbed for example by forests or the atmosphere.

In May 2021, the International Energy Agency (IEA), published its Roadmap for the Global Energy Sector for a Net Zero by 2050 scenario. The IEA Net Zero by 2050 Scenario expects almost half the reductions in 2050 to come from “technologies that are currently at the demonstration or prototype phase”. In heavy industry and long-distance transport “the share of emissions reductions achieved by technologies that are still under development is even higher” according to the IEA report. Further, these new technologies are likely to be deployed in an environment characterized by new and volatile policy and carried out by inexperienced actors. Add to this that everything needs to happen very fast; 2050 is less than thirty years away.

The IEA report heralded the description of climate change as “a strong recipe for disputes.” The 2022 QMUL survey now confirms this side of the energy transition. It notes not only that disputes relating to the energy transition are expected to increase, but also that parties will need to “grapple with the design and delivery of new technologies, with new players potentially entering the energy market”.

The survey notes that respondents felt new technology would be a much more common cause of international disputes than in the past five years. The report also identifies wind, solar and hydrogen as sectors where the development and deployment of new technology comes with a particular high risk of disputes.

The New Energy Infrastructure and Dispute Prevention and Early Resolution

The types of contracts associated with energy projects are highly diverse – from financing institutions to providers of technology, services, and construction, to government actors – but they are likely to share two common features: the introduction of new technologies and the need for timely completion of projects, often on an accelerated time scale.

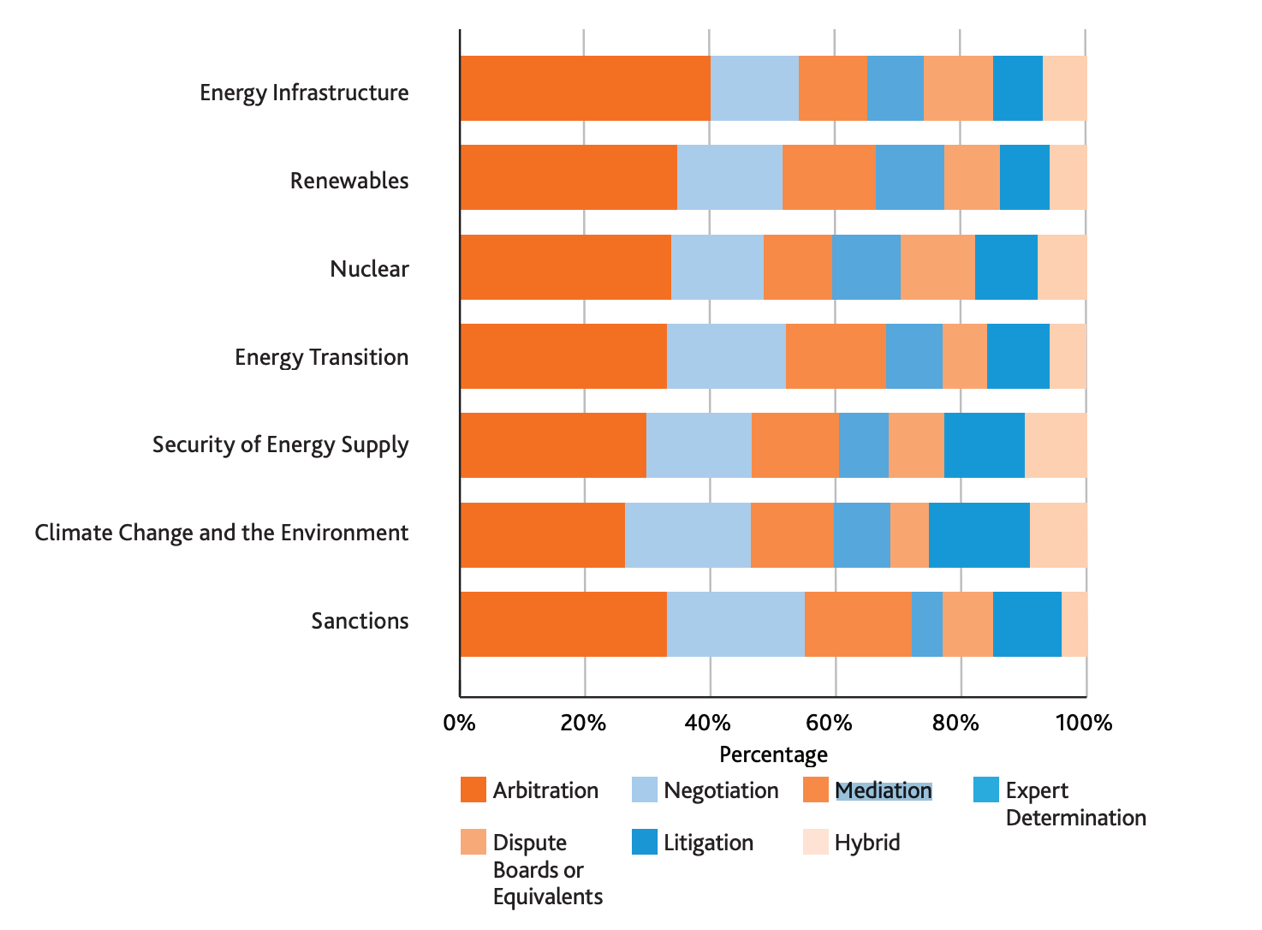

Against this backdrop, parties may wish to include in their contracts a method of dispute resolution that allows them to keep a project on track through conclusion. In this, we draw a different conclusion from the report’s authors, who believe that arbitration emerged as a “clear favorite” over other forms of resolution such as negotiation and mediation. We do not interpret the responses as preferring arbitration over these and other methods. Rather, the data appears to indicate that parties in energy projects view them as complementary means that can precede or take place alongside arbitration or court litigation:

What these other dispute resolution methods have in common is that they are designed to prevent disputes or resolve them early, while preserving the parties’ ability to seek binding resolution in arbitration or courts. The use of these mechanisms would be consistent with the respondents’ desire for speed of resolution, which is also highlighted elsewhere in the study:

Half of all respondents (and 66% of end users) selected expedited procedures (including faster constitution of arbitral tribunals and time limits for awards). This is consistent with a theme seen on a day-to-day basis by many of our international arbitration practitioners that all stakeholders of the arbitral process would like to see it become more efficient. Most respondents considered that the responsibility for expediting the process falls on arbitrators and they wanted to see arbitrators empowered to dispose of claims at an early stage.

Thus, in-house and external counsel will find that the report offers support for the inclusion of these dispute prevention and early resolution mechanisms in contracts, in order to reach an outcome earlier than a final arbitral award.

Interestingly, the survey found relatively little support for the use of dispute boards, despite their use in various sectors of the construction industry to prevent disputes and keep projects on track. The report notes that “unpopularity” of this method among the survey’s respondents could be due simply to lack of familiarity in the energy sector.

Dispute boards were relatively unpopular with respondents, except for disputes relating to “energy infrastructure” (11%) and “nuclear” disputes (12%). In these latter categories, it is very likely at the outset of a project that disputes will arise. Therefore, the more proactive form of dispute resolution offered by dispute boards made sense to respondents who had experience with them.

This observation is similar to comments received from business leaders during a summit of energy industry leaders in Italy, held in May 2022, at which the co-authors participated. Summit participants discussed many of the impediments to building new energy infrastructure, including disputes. When a suggestion of dispute boards was floated among those in attendance, the business leaders commented favorably on the possibility of regular meetings being used to overcome obstacles, instead of deferring them to litigation at the end of a project. Some of those in attendance were aware that a similarly collaborative approach between government owner and private contractor had contributed to the reconstruction of Genoa’s collapsed “Morandi” bridge in record time and saw no reason why it could not be adopted in the energy sector.

Regulatory Disputes

As public and private actors in various degrees are gearing up to meet the climate change challenge at different levels, we are likely to see an increasing presence of climate change-related issues in many dispute resolution settings. The survey notes the increased prominence of regulatory issues across industries as a source of future disputes, arising from “the desire of governments to address the impact of climate change and the corresponding drive towards cleaner energy”.

If disputes stemming from increased regulation are expected to substantially increase due to climate change, it is closely followed by “commercial disputes”. The latter clearly representing a wide range of disputes, and the survey mentions price fluctuation disputes as one element in this category.

Who Is in the Driver’s Seat?

The survey reveals an interesting discrepancy between the views of corporates and in-house counsel on the one hand, and the entire respondent group, on the other, in the matter of how much respondents predict that climate change may impact their activities. Analyzed in isolation, the majority of corporates and in-house counsel (representing 16% of the respondents) say that climate change and environmental considerations are expected to have “a significant impact”. However, the respondent group taken as a whole expects only a “moderate” impact.

The numbers suggest that many in-house counsel are more aware of the role of climate change for their business than their external counsel. This is likely a reflection of a general development of how climate risks are becoming a standard element in corporate risk assessment. Many corporations face climate change on a daily basis through their involvement in climate mitigation projects, including energy transition investments, or when being forced to adapt to the impacts of climate change.

Outside counsel are well advised to follow suit and to include a climate change perspective in all client work. The recently published guidance from the UK Law Society on the impact of climate change on solicitors offers a good example of what this may look like in practice.

In conclusion, the QMUL survey confirms that climate change issues are front and center of today’s reality of the energy sector. It therefore represents an essential piece of the puzzle for arbitration practitioners and in-house counsel looking to optimize planning and preparing for dispute resolution in the energy sector.

________________________

To make sure you do not miss out on regular updates from the Kluwer Arbitration Blog, please subscribe here. To submit a proposal for a blog post, please consult our Editorial Guidelines.

I fully concur with the idea. This was also the conclusion of the autumn meeting of the German Institution of Arbitration last year. I also voiced this during last years PAW at the hybrid webinar given by our lawfirm network Unyer. We already then said that the effectiveness of the climate change transition will depend on the effectiveness of the dispute resolution clauses.